Because Excel can hold and process a lot of data at a time, it can easily become overwhelming to try to keep track of everything.

If you have any calculations on your worksheet, you will want them to be done quickly and simply, without disrupting the orderliness of your data.

Quick Jump

ToggleWhat Is the GST Formula?

The GST formula is a tool that allows you to easily calculate the amount of goods and services tax (GST) on your purchases. The GST amount is calculated based on the price of a given product or service and is added to the total amount you owe. When you purchase goods or services from a GST-registered business, you are usually charged GST.

This article will show you how to use the GST formula in Excel to make sure you are correctly calculating your GST liability. Let’s get down to business!

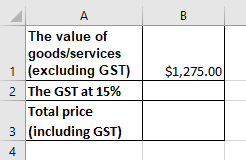

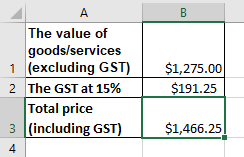

Before calculating the GST formula, you need to prepare the data that will be displayed. In the example below…

- “B1” is the cell with the value of goods/services (excluding GST).

- “B2” is the cell with the GST value at 15% to be calculated.

- “B3” is the cell with the total price (including GST) to be calculated.

How to Calculate GST in Excel

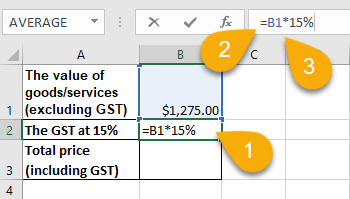

1. Click on the cell where you want to calculate GST at 15% (B2).

2. Go to the Formula bar.

3. Write the formula “=B1*15%.”

Note: Alternatively, you can write the formula as “=B1*.15”. Either way will work.

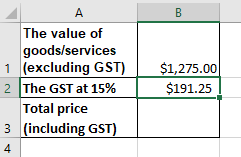

4. Press the Enter key on your keyboard.

As easy as that, your GST value has been calculated.

Now let’s show the calculation for the total price, including GST.

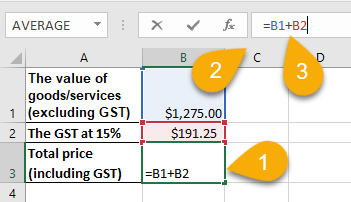

1. Select the cell where you want to calculate the total price (B3).

2. Navigate to the Formula bar.

3. Type the formula “=B1+B2.”

4. Press the Enter key on your keyboard to get the result.

And there you go! The calculations have been completed.

The GST formula in Excel is a helpful tool to use when calculating your GST liability. By following the steps outlined in this article, you can ensure that you are correctly calculating the amount of GST you owe on your purchases. As an alternative, you may want to do a prorate calculation in Excel to come up with your GST value.

This will help you to avoid any penalties or interest charges that may be applied if you underpay your GST liability.