Are you feeling overwhelmed by mounting debts and unsure of how to pay them off? Do you find yourself constantly worrying about your financial future? You’re not the only one.

Dealing with debt can be stressful and confusing, especially when you’re trying to balance multiple payments and interest rates. But what if there was a simple, organized way to manage your debt payoff in 2025? Enter Google Sheets Debt Payoff Templates.

These user-friendly templates are designed to help you map out your debt payoff strategy, giving you a clear picture of your financial situation and a concrete plan to become debt-free.

In this article, we’ll share 8 free Google Sheets Debt Payoff Templates for 2025 to help you take control of your finances. Whether you’re dealing with student loans, credit card debt, or personal loans, these templates have got you covered.

Quick Jump

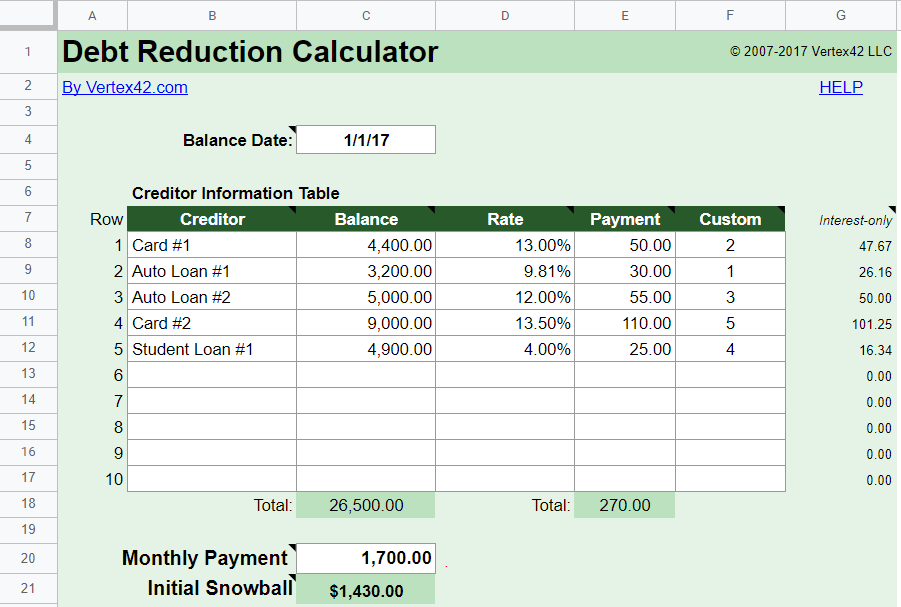

Toggle1. Free Downloadable Debt Reduction Template

Designed by Vertex42

Get a handle on your finances and start making a dent in your debt with this Debt Reduction Template from Vertex42. Designed to be used with Google Sheets, this template is more than just a calculator – it’s a comprehensive guide to managing and reducing your debt.

The template is designed to help you strategize how to pay off your debt. It offers multiple strategies like the Snowball method (paying the lowest balance first) and the Avalanche method (paying the highest interest first). You can also customize your own strategy based on your unique circumstances.

With a clear table to input your creditor information, you can easily keep track of your balances, interest rates, and payments. It even provides tips for making decisions about which debts to pay off first.

The Debt Reduction Template also includes a warning system to alert you if you’re not maintaining a constant monthly payment, helping you stay on track toward your goal.

2. Debt Repayment Template

Designed by Medium

It’s never easy to tackle debt, but having a clear plan in place can make it a whole lot more manageable. This comprehensive template is designed to help you understand your current debt situation and make a plan to pay it off.

The template starts by asking you to input your starting debt, payment frequency, interest rate, and how often it compounds. Once you’ve inputted these values, the template does the heavy lifting by calculating your remaining debt and time to pay off for each month.

The spreadsheet lists out each month, along with the payment you’ll make, the remaining debt after that payment, and a timeframe for how long it will take you to become debt-free. It’s a sobering but necessary view of your financial situation. The beauty of this template is seeing how your debt decreases over time, providing you with a visual representation of your progress.

The Debt Repayment Template isn’t just a spreadsheet. It’s a roadmap to financial freedom. It allows you to see the light at the end of the tunnel and motivates you to stay on track with your payments. It’s a perfect companion in your journey towards a debt-free life. And the best part? It’s available on Google Sheets, making it easily accessible wherever you are.

3. Dave Ramsey Debt Snowball Template

Designed by Sheryl Killoran

Dave Ramsey’s Debt Snowball template is a Google Sheets template designed by Sheryl Killoran that offers a structured yet flexible way to regain control of your finances. It’s based on Dave Ramsey’s debt snowball method, where you focus on paying off your smallest debts first while maintaining minimum payments on larger ones. This approach helps create momentum and motivation as you start to see debts disappear.

The template is divided into several sections, each serving a specific purpose. The ‘Snowball’ section helps you keep track of your debt payoff progress, listing each debt item, total payoff amount, minimum and new payments, and the number of payments remaining.

The ‘Monthly Income’ section allows you to record your income from various sources, while the ‘Monthly Budget’ section lets you allocate spending to different areas of your life. It covers everything from housing and utilities to personal expenses, transportation, and even charitable gifts.

The ‘Allocated Spending Plan’ section is where you can plan your spending for each pay period. The ‘Notes/Comments’ column is great for adding personal reminders or tips to help you stay on track.

In addition, there’s a ‘Cash to withdraw each pay period’ section to help you manage your cash flow. The template is comprehensive and detailed, yet easy to use, making it a great companion for anyone looking to reduce their debt and improve their financial health.

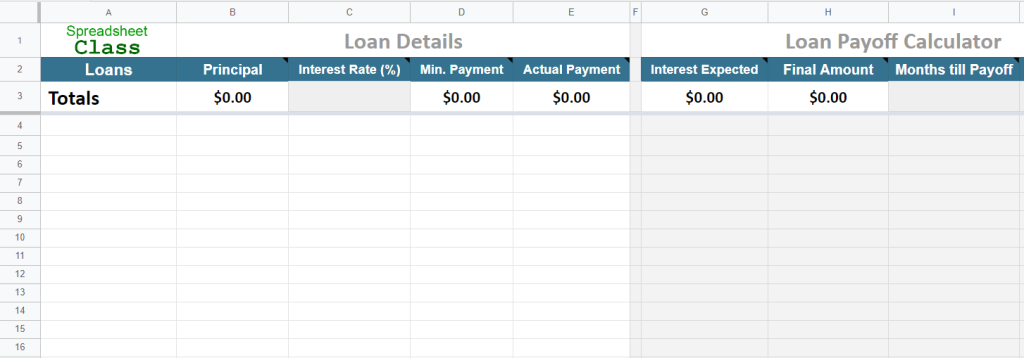

4. Debt Payoff Template

Designed by Spreadsheet Class

Get your financial life on track with the Debt Payoff Template on Google Sheets designed by Spreadsheet Class. This isn’t just another spreadsheet. It’s like a compass that points you to the quickest route to pay off your loans.

The template helps you calculate your loan details with utmost accuracy. You just need to input your loan principal, interest rate, and minimum payment. The template then calculates the final amount, months till payoff, and years till payoff. Want to pay off your loan faster? Tweak the ‘actual payment’ field and watch as your payoff date moves up.

But that’s not all. This template also gives you a holistic view of your total loans, expected interest, and the final amount you’d be paying over the lifetime of the loans. With all this information at your fingertips, you can make informed decisions and strategize your repayments.

The Debt Payoff Template is more than just numbers and calculations. It’s about taking control of your debts, understanding them, and making them work for you. It’s about feeling empowered, not overwhelmed. It’s about changing your life, one payment at a time.

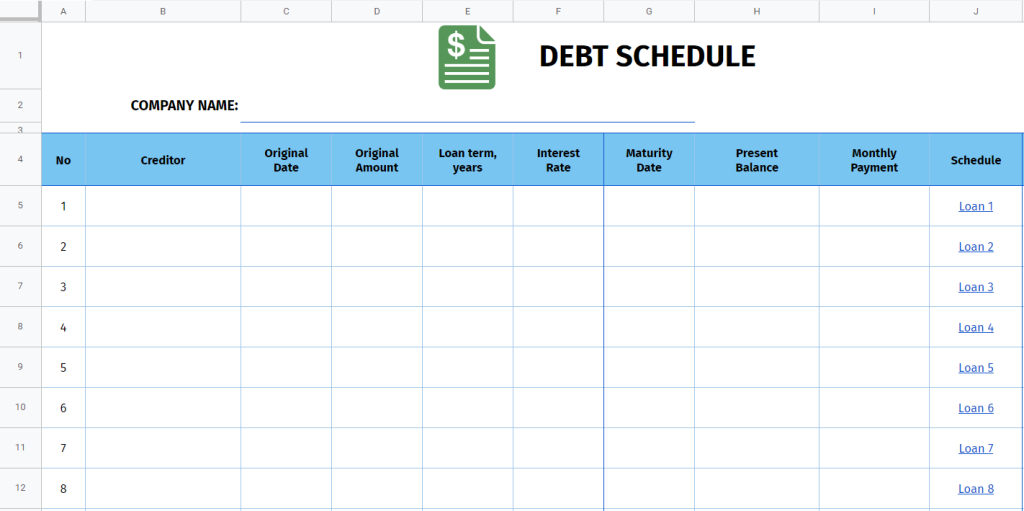

5. Debt Schedule Template

Designed by GooDocs

Imagine having all your debts organized in one place. Sounds convenient, right? That’s exactly what the Debt Schedule Template on Google Sheets offers. This template by GooDocs is a great way to keep track of all your obligations. With this template, you can efficiently manage your loans and stay on top of your repayment schedule.

The template allows you to list up to ten different loans, each with its own detailed breakdown. You can input the creditor, original amount, loan term in years, interest rate, maturity date, present balance, and monthly payment for each loan. You can also include the schedule, collateral, and loan purpose for a comprehensive overview.

But wait, there’s more! Each loan also has a detailed payment schedule where you can record the payment date, scheduled payment, loan balance, principal amount, and interest amount. It even calculates the cumulative interest amount for you. This is particularly useful to see how much interest you’re paying over time and how much is left on your loan balance after each payment.

Simply put, this Debt Schedule Template can be your personal debt manager, helping you stay organized, informed, and proactive about your financial obligations. It’s a great way to take control of your debts and your financial future.

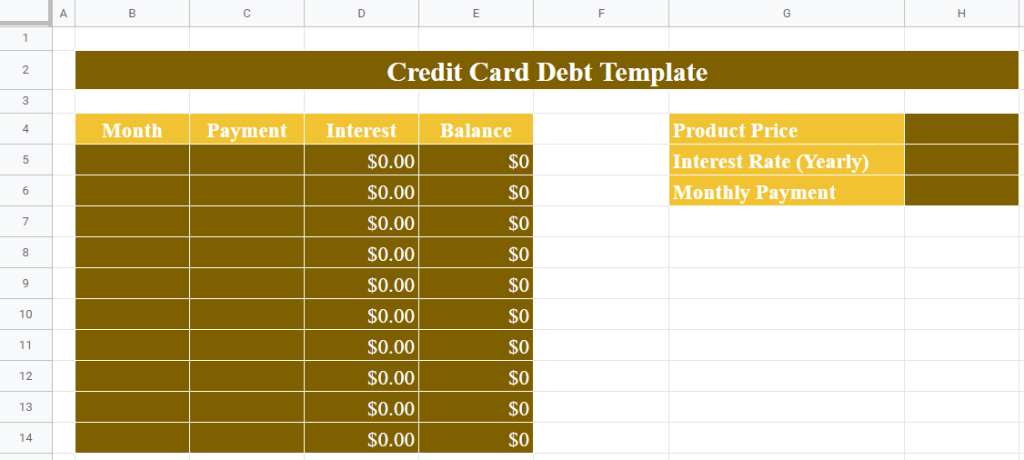

6. Сredit Сard Debt Template

Designed by Spreadsheet Daddy

Dealing with credit card debt can be overwhelming. But don’t worry, the Сredit Сard Debt Template from Spreadsheet Daddy is here to help you navigate this tricky terrain. Using this Google Sheets template, you’ll be able to clearly see what’s happening with your debt.

The template is organized in a user-friendly way, with designated sections for the month, payment, interest, balance, and product price. You’ll also be able to input your yearly interest rate and monthly payment, making it easy to track your progress.

Each month, just enter your payment and the interest you’ve accrued, and the template will automatically calculate your remaining balance. You can also add the price of any new purchases you’ve made on your credit card.

This interactive template gives you a clear view of your debt and how it’s decreasing over time. It’s like a roadmap, guiding you through your debt repayment journey. Just fill in the blanks, and the template does the rest.

One of the great things about this template is how customizable it is. You can edit the fields to match your specific situation. Plus, since it’s on Google Sheets, you can access it from anywhere, at any time.

Whether you’re a seasoned budgeter or just starting out, the Сredit Сard Debt Template is a helpful companion in your journey to becoming debt-free.

7. Business Debt Schedule Template

Designed by Spreadsheet Daddy

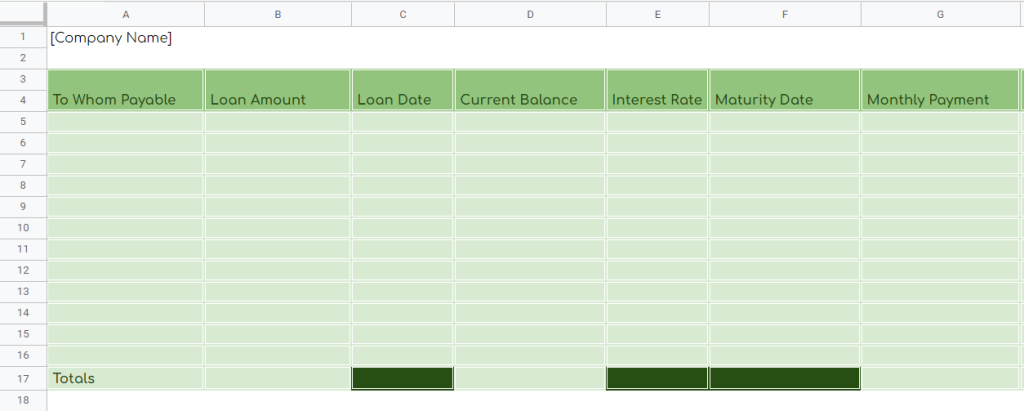

Stepping into the world of business can be exciting and daunting at the same time, especially when it comes to managing finances. One of the challenging aspects is keeping track of loans and debts. That’s where the Business Debt Schedule Template from Spreadsheet Daddy comes into play, exclusively designed for Google Sheets.

Imagine having all your business loan details, from the loan amount, date, current balance to the interest rate, and even the collateral information at your fingertips. This template is just like that – a comprehensive dashboard for your debt management.

The template is intuitively designed to serve the needs of businesses of all sizes. It comes with fields for the ‘Company Name’ and ‘Date’, followed by a detailed loan breakdown. ‘To Whom Payable’ helps you keep track of your lenders, while ‘Loan Amount’ and ‘Current Balance’ let you monitor the money flow. ‘Interest Rate’, ‘Maturity Date’, and ‘Monthly Payment’ sections give you a clear picture of your repayment plan.

What if you have collateral against your loans? No worries. There’s a section for that too! Plus, you can track if your payments are ‘Current or Past Due’. The ‘Totals’ at the end will provide a quick glance at your overall debt status.

8. Personal Debt Schedule Template

Designed by Spreadsheet Daddy

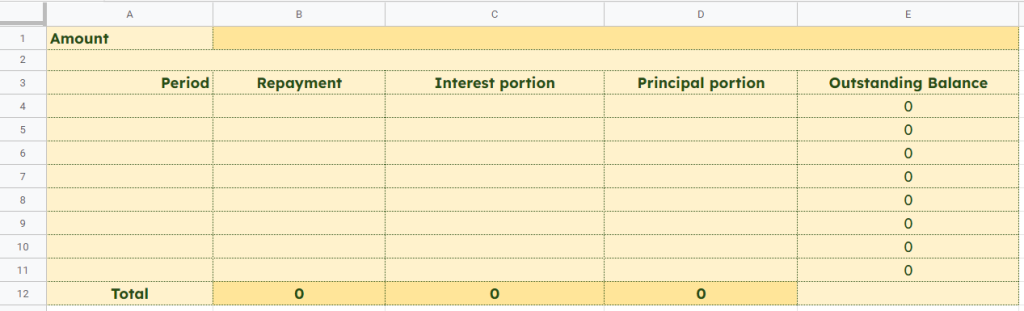

Navigating through personal debt can feel like a maze, but it doesn’t have to be. The Personal Debt Schedule Template designed by Spreadsheet Daddy is your personal guide, helping you keep track of your debt repayment schedule in a clear and organized manner.

The template is divided into two sheets, each breaking down your debt in an easy-to-understand format. It features columns for the amount, period, repayment, interest portion, principal portion, and outstanding balance.

Imagine this: you’ve got a student loan and a car loan. You can use Sheet1 for your student loan and Sheet2 for your car loan. For each loan, you can record the total amount, repayment periods, and break down your repayments into the interest and principal portions. This way, you can see at a glance how much of your repayment is actually reducing your debt and how much is just covering the interest.

But that’s not all! The template also calculates your outstanding balance after each repayment. This way, you can see your progress in real-time and celebrate each step you take toward financial freedom.

In short, this Google Sheets template is like having a personal financial advisor, helping you stay on top of your debt and navigate your way out of it. So, why not give it a try?