Keep your finances organized without the hassle!

Our Checkbook Register Template is free, easy to use, and compatible with Google Sheets, Excel, and PDF.

Quickly log transactions, track balances, and see exactly where your money goes.

Quick Jump

ToggleWhat Is a Checkbook Register Template?

A checkbook register template is a tool used to track and record all financial transactions in a checking account, including deposits, withdrawals, checks written, and debit card purchases.

Using a checkbook register lets you monitor your spending, avoid overdrafts, and reconcile your records with your bank statements.

Download Spreadsheet Daddy’s Free Checkbook Register Template

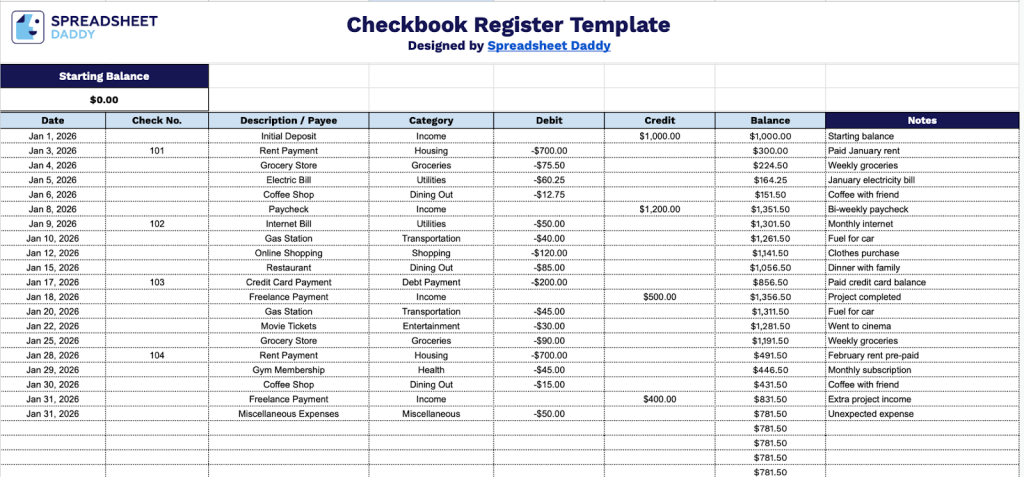

Our Checkbook Register Template helps you track your income and expenses in an organized way.

What’s included

- Starting balance field: The header section includes an editable starting balance field that lets you enter your initial account balance before recording any transactions, ensuring accurate balance tracking throughout the register.

- Comprehensive transaction tracking columns: Each row includes dedicated fields for Date, Check Number, Description/Payee, Category, Debit, Credit, Balance, and Notes, enabling you to capture complete details of every financial transaction in an organized, standardized format.

- Running balance calculation column: The Balance column displays after each transaction entry, designed to show your updated account total as you record debits and credits, helping you maintain real-time visibility of your available funds.

You can easily customize it by adding or removing columns to fit your specific tracking needs.

Download a free blank checkbook register template in your preferred format using the links below:

How to Use Our Checkbook Register Template

1. Access the template in PDF or Excel, or duplicate it to Google Sheets for personal use.

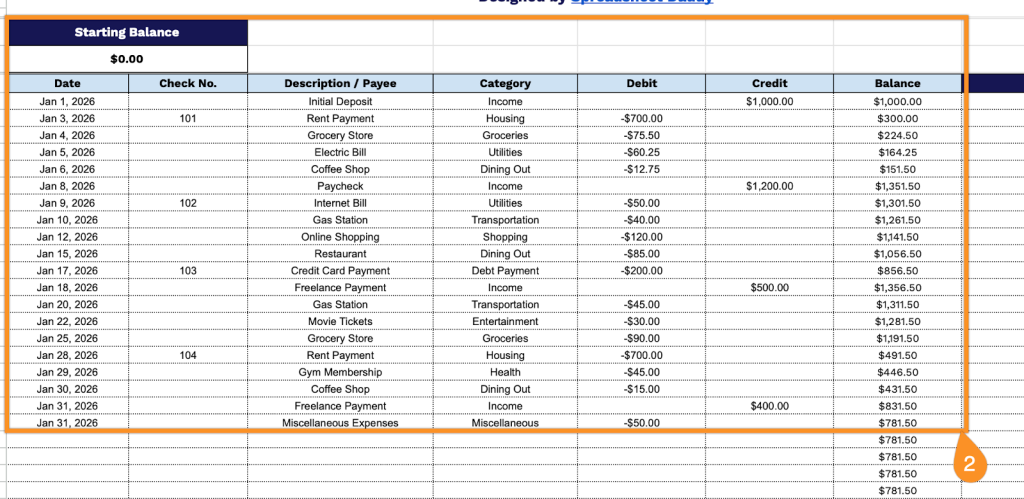

2. Add your Starting Balance and complete the columns by entering all essential financial tracking information:

- Date: Record the exact date when each transaction occurred or was processed.

- Check No.: Enter the check number for payments made by check (leave blank for other transaction types).

- Description / Payee: Specify who received the payment or the source of the deposit, along with a brief transaction description.

- Category: Classify the transaction type (groceries, utilities, salary, rent, etc.) for expense tracking purposes.

- Debit: Enter amounts for money leaving your account (expenses, withdrawals, payments).

- Credit: Record amounts for money coming into your account (deposits, income, refunds).

- Balance: The template automatically calculates and updates your running account balance after each transaction entry.

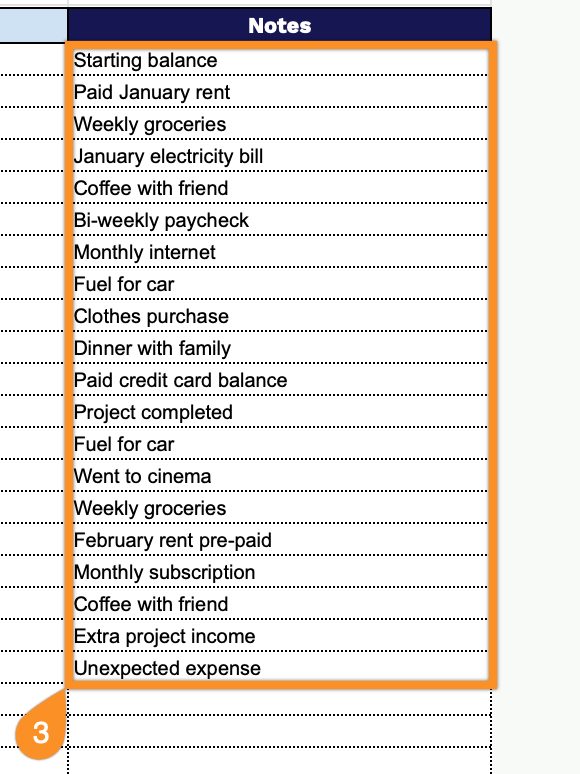

3. Use the Notes section to add extra details, reminders, or essential transaction information.