Do you spend far too much time creating payrolls manually? Would you like to improve the payroll process and save yourself a lot of hassle? In addition to eating up precious time, a manual payroll system also tends to be prone to errors—and payroll errors turn into employee dissatisfaction. As much as 24% of employees will start seeking a new job after the first payroll error.

You want a payroll system that is free, fast, and error-free.

It may surprise you that using one of Google Sheets’ payroll templates could be the answer to your problem. They are free and save you time and effort in managing your employees’ payrolls. They are also equipped with dynamic tables and filters that easily and quickly calculate the company’s payroll.

Check out the article below to learn about five free Google Sheets payroll templates and how to use one of these templates in Google Sheets.

Quick Jump

ToggleWhat Is a Google Sheets Payroll Template?

The Google Sheets payroll template is a cloud-based, pre-designed document that helps employers organize, calculate, and track employees’ payroll data—information required for the payroll process.

Companies use such documents to manage their payroll process. The Google Sheets’ payroll template is a preformatted document; all you have to do is fill in the applicable information. These templates are free and editable.

You can personalize these templates by adding or removing columns and rows to match your needs. These templates also have an automatic calculation system, saving you time and avoiding miscalculations. The payroll templates provided by Google Sheets include these features:

- Employee name

- Pay issue period and date

- Total working hours

- Gross pay

- Taxes

- Net pay

Why Use a Google Sheets Payroll Template?

Big companies have budgets for accountants and expensive software (Gusto, QuickBooks, etc.) to manage the company’s payroll system. But small businesses don’t always have the budget to hire specialists or use high-end programs to create payroll records.

According to Clutch, 25% of small businesses still record finances on paper, risking errors and security breaches. The payroll templates offered through Google Sheets provide the perfect option for them.

Consider these reasons why you should look into using a payroll template through Google Sheets:

1. Free: They are free. You only need a Gmail account to use them.

2. Secure: Google Sheets templates are secure as they‘re encrypted and password protected.

3. Better than Excel: Google Sheets payroll templates are better than Excel as they allow automatic calculations.

4. Various uses: Use payroll template information to prepare legal documents.

5. Customizable: Create different payroll templates in Google Sheets to fit your needs. For example:

- HR management payroll templates

- Payroll deduction templates

What Are the Benefits of Using a Google Sheets Payroll Template?

Google Sheets payroll templates are amazing business tools that a finance team of any size can use. Whether you are a small business owner or on the finance team of a large company, you can enjoy the many benefits of Google Sheets’ payroll templates.

Let’s look into some of the top benefits of using Google Sheets payroll templates:

1. Smooth business operations: Record all payment information for your employees to ensure they are paid on time and to avoid any legal issues.

2. Save time: Use formulas to automate calculations. Put your data in the cells, and the template will do the rest of the work. It frees you up for other tasks.

3. Streamline operations: Automate payroll tasks. This helps streamline the payroll process.

4. Automatically save data: Save data automatically with cloud storage. Google Sheets includes a document’s version history, allowing you to switch back to a previous version if necessary.

5. Easy to use: No need to be an accounting expert to use Google Sheets’ payroll templates, nor do you need to know complex formulas and functions. Let the template handle the complex side of things.

What Should a Google Sheets Payroll Template Include?

A Google Sheets payroll template includes all information required for creating payroll, such as the following:

- Payment date: Pay issue date to the employee

- Employee information: All employee information like employee name, ID, email address, and phone number

- Regular hours: Specific number of work hours for an employee set by the company (usually 40 hours per week)

- Overtime hours: Total hours an employee worked beyond regular hours

- Regular rate: The hourly rate an employee is paid for doing regular work hours

- Overtime rate: An employee’s hourly rate for doing overtime hours

- Gross pay: Pay prior to deductions (such as taxes)

- Deductions: Payments deducted from employees’ total earnings to pay state tax, federal tax, health insurance, etc.

- Payroll tax: A percentage deducted from an employee’s salary that is paid to the government to fund public services such as social security, Medicare, etc.

- Net pay: Total pay an employee receives after all deductions

5 of the Best Google Sheets Payroll Templates

The payroll process can be time-consuming and complicated. Payroll templates are excellent tools to simplify and speed up the payroll process. Google Sheets offers payroll templates to companies of any size.

You can make a payroll template from scratch in Google Sheets or import them from third-party websites. There are ready-made templates that you can edit according to your needs. Simply put data into the fields, and the template will do the rest of the work.

Here are five of the best Google Sheets payroll templates to help you manage your company’s payroll system.

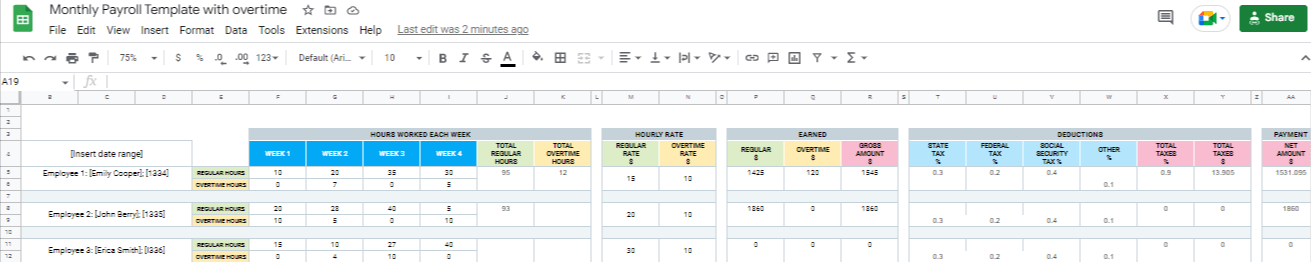

1: Google Sheets Payroll Register Template

Template source: Smartsheet

Successfully running a business requires more than just sending out a payroll. You must record all payroll information even after paying wages for taxing issues.

This is where this Google Sheets payroll template comes in handy. It contains all the information about your employees’ wages and pay period.

The following are essential details to include in the payroll register:

- Pay period (start date, end date, pay date)

- Employee name

- Hourly wages

- Total work hours

- Gross pay

- State tax

- Federal tax

- Social security

- Medicare

- Total withholding

- Insurance

- Net pay

Why use the Google Sheets Payroll Register Template?

1. Use it to track records of your employees’ weekly, monthly, and yearly salaries, deductions, total work hours, and payment dates.

2. Every year you must file taxes and provide payroll tax reports when running a company. Payroll Register Templates help you keep track of all the information needed for tax deposits and tax reports.

3. Payroll register templates are also helpful in estimating wage budgets.

4. You can use this information to make wage reports and annual W2 forms for each employee.

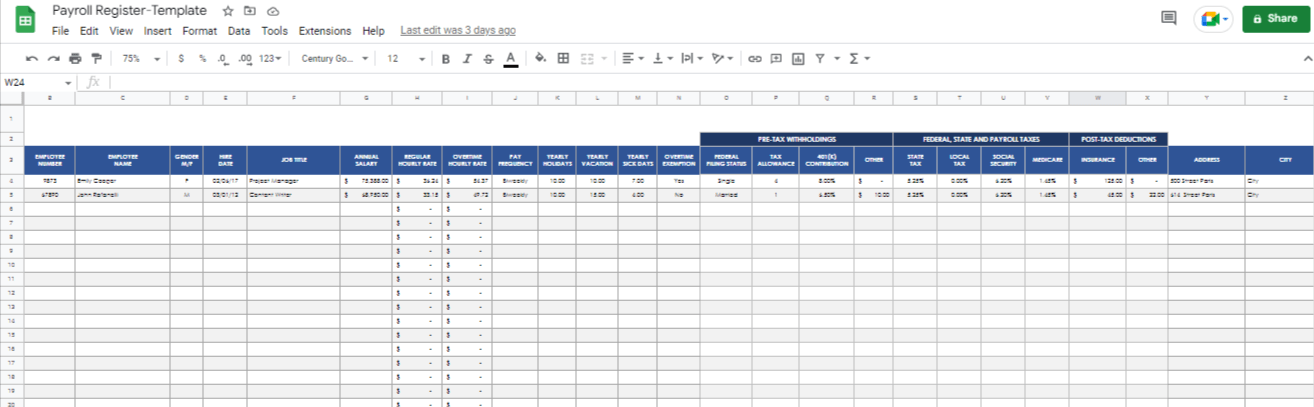

2: Google Sheets Payroll Timesheet Template

Template Source: Clockit.io

Time tracking is essential for calculating pay. If you don’t have a proper time tracking system for your employees, then you should use the Google Sheets Payroll Timesheet Template.

This template allows you to track your employees’ work hours. Categorize and calculate total regular, overtime, and holiday hours. Employees use it to log hours worked on each task and their time in and time out.

There are five types of Google Sheets Payroll Timesheet Templates:

1. Daily Timesheet Templates

2. Weekly Timesheet Templates

3. Biweekly Timesheet Templates

4. Monthly Timesheet Templates

5. Project Timesheet Templates

Create a template according to your company’s requirements.

Why use the Google Sheets Payroll Timesheet Templates?

1. Other time-tracking systems can be expensive and difficult to use. These Google Sheets Timesheet Templates are easy to use and free.

2. Often, employees forget to save the documents with the information on their hours of work. Google Sheets is a cloud-based system, so you don’t need to worry about losing your timesheets. Moreover, you can monitor your team’s working hours from anywhere.

3. You don’t need to chase down your employees to fill out their timesheets or worry about them losing them. Google Sheets has a sharing option. Create a timesheet template once and then share it with the team. As your entire team submits their working hours on one sheet, it also reduces the chances of miscalculating.

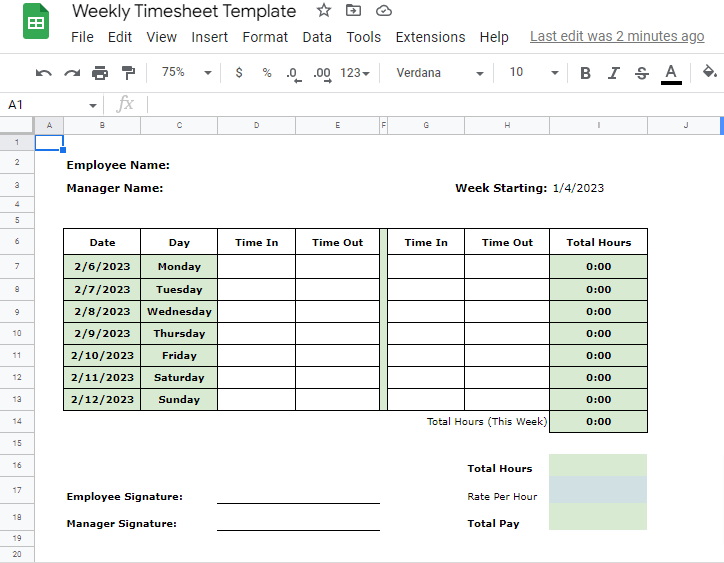

3: Google Sheets Payroll Budget Template

Template source: Clockify

Payroll is an integral expense of a business. If you don’t have an estimation of pay, there are chances of overspending and money shortage. Creating a payroll budget is necessary to run a smooth business. Here, the Google Sheets Payroll Budget Template is your savior.

This template can help you plan and track your budget for payroll. Many companies use documents like these in their business planning phase.

Select a specific period for budget calculation in the template, such as monthly, quarterly, or annually. In the template, add employee information, hourly rates, and estimated work hours, and the template will give you an estimated budget.

Why use the Google Sheets Payroll Budget Template?

1. It’s useful to allocate your budget to different departments in your company.

2. This template is especially helpful when hiring staff and making other financial decisions like employee raises and benefits.

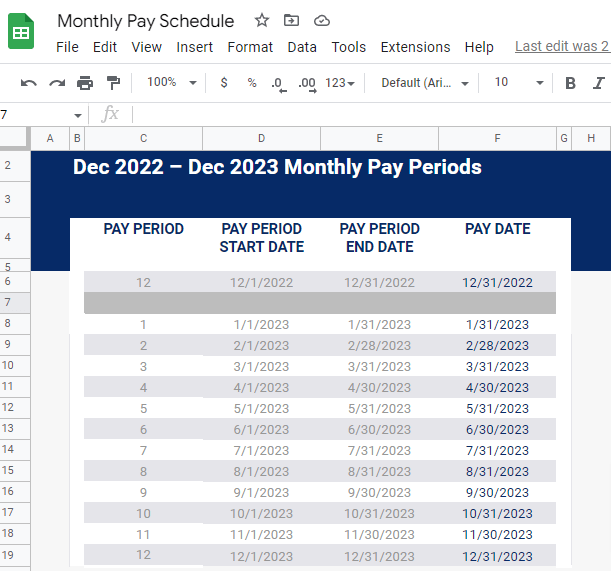

4: Google Sheets Payroll Schedule Template

Template source: Hourly.io

What is the secret to keeping your employees happy? Paying them on time. You should have a proper system to pay your employees on time. Payroll Schedule Templates are the perfect option.

The Google Sheets Payroll Schedule Template determines the day you issue wages to your employees. If your employees submit their timesheets to you, you can also use this template to inform them of timesheet submission dates.

There are four Payroll Schedule Templates:

1. Monthly

2. Semimonthly

3. Biweekly

4. Weekly

Decide which payroll schedule suits your business needs.

Payroll Schedule Templates include the following:

- Payroll period

- Pay period start date

- Pay period end date

- Pay date

Why use the Google Sheets Payroll Schedule Template?

1. It frees your employees from the frustration of waiting for payment, improving employee morale and satisfaction.

2. It saves you from legal issues as it’s a law and regulation to have a schedule to pay your employees.

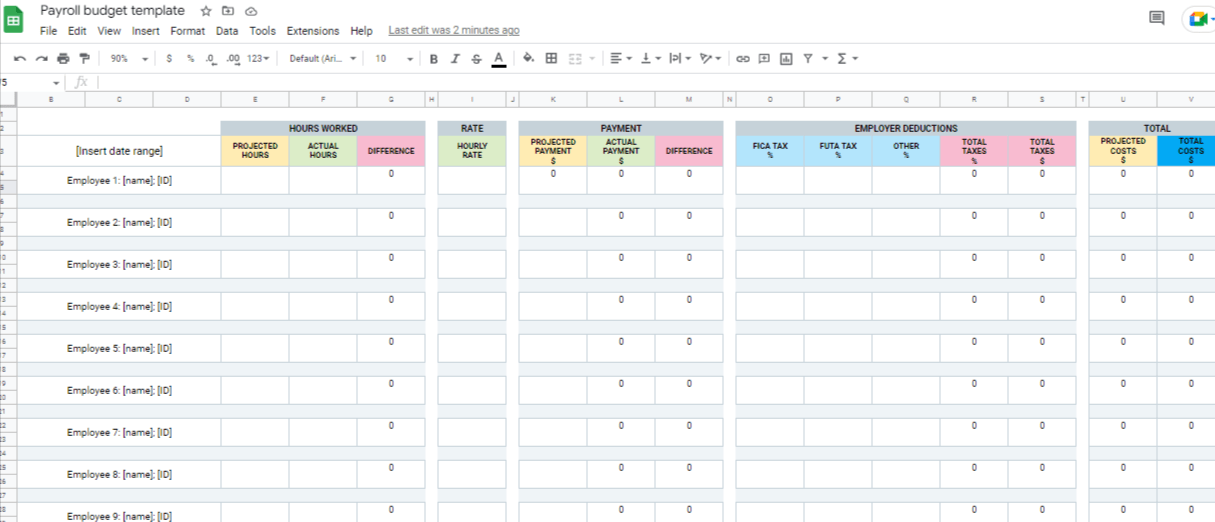

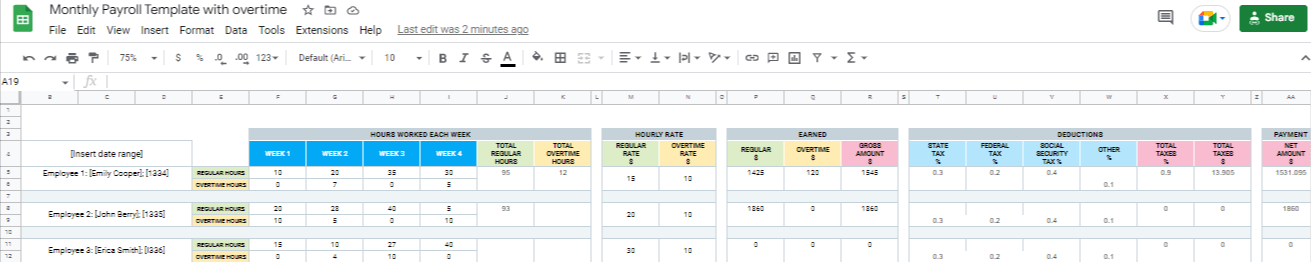

5: Google Sheets Monthly Payroll Template

Template source: Clockify

A monthly payroll template is the simplest and most effective payroll system if your company issues monthly pay. The monthly payroll includes many variables, and it’s challenging to calculate them manually.

The Google Sheets Monthly Payroll Template provides automatic solutions to calculate your employees’ monthly payrolls, providing each employee’s net monthly income for total work hours (regular and overtime, PTO hours), taxation, and gross pay.

Why use the Google Sheets Monthly Payroll Template?

1. It’s a flexible template. You can customize it according to your business needs. Some businesses only need regular hours to calculate pay, while others include PTO and taxes.

2. Monthly Payroll Templates save time as you work on payroll only once a month. In other payroll systems, you spend time daily or weekly in payroll preparation.

3. The processing cost is the lowest since you only process 12 days a year.

How to Use a Google Sheets Payroll Template

Managing payroll is a hectic task for a business, but Google Sheets makes it easy. This cloud-based program allows you to customize your templates and store your payroll information in one place. If you want to see how a payroll template works in Google Sheets, check out the section below.

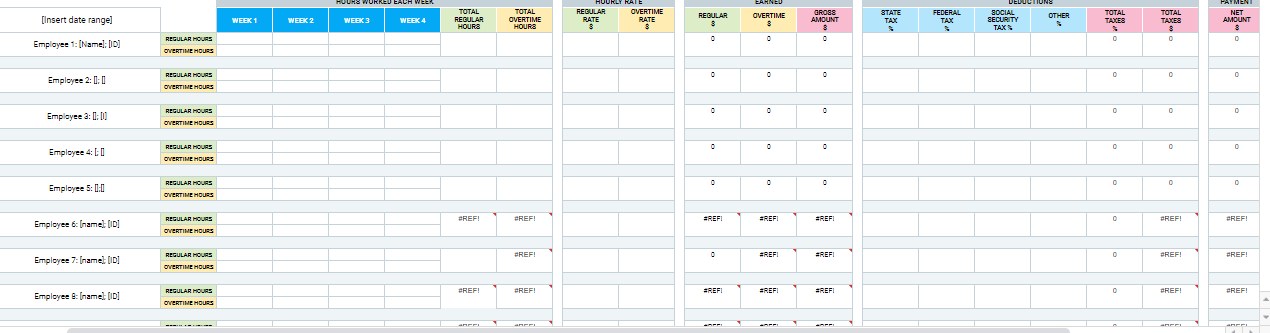

Here is a step-by-step method to show how to customize a monthly Google Sheets payroll template:

1. Open up one of the Google Sheets Monthly Payroll Templates reviewed above. Fill the headers with payroll details, such as employee information, tax details, work hours, gross pay, and net pay.

2. After completing the headers, fill the sheet with the required information for each employee.

3. Now, use formulas to calculate total hours, extra working hours, total taxes, deductions, net pay, and gross pay. Google Sheets has built-in formulas that you can use for these calculations. We will show you how to calculate pay using such formulas.

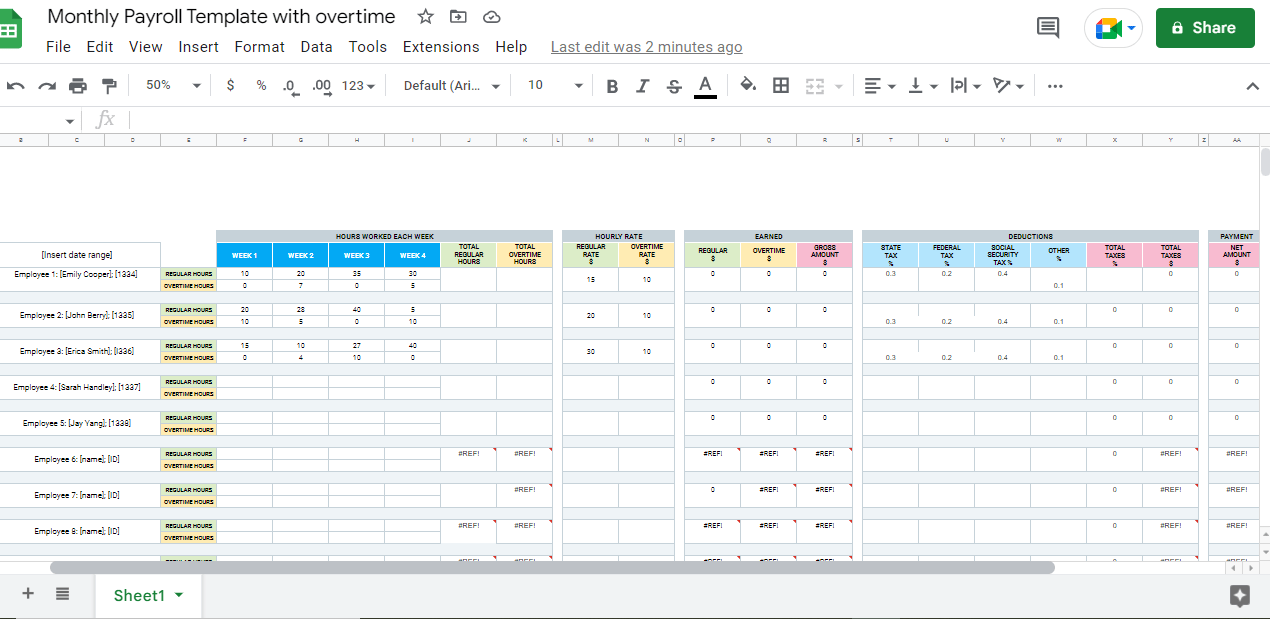

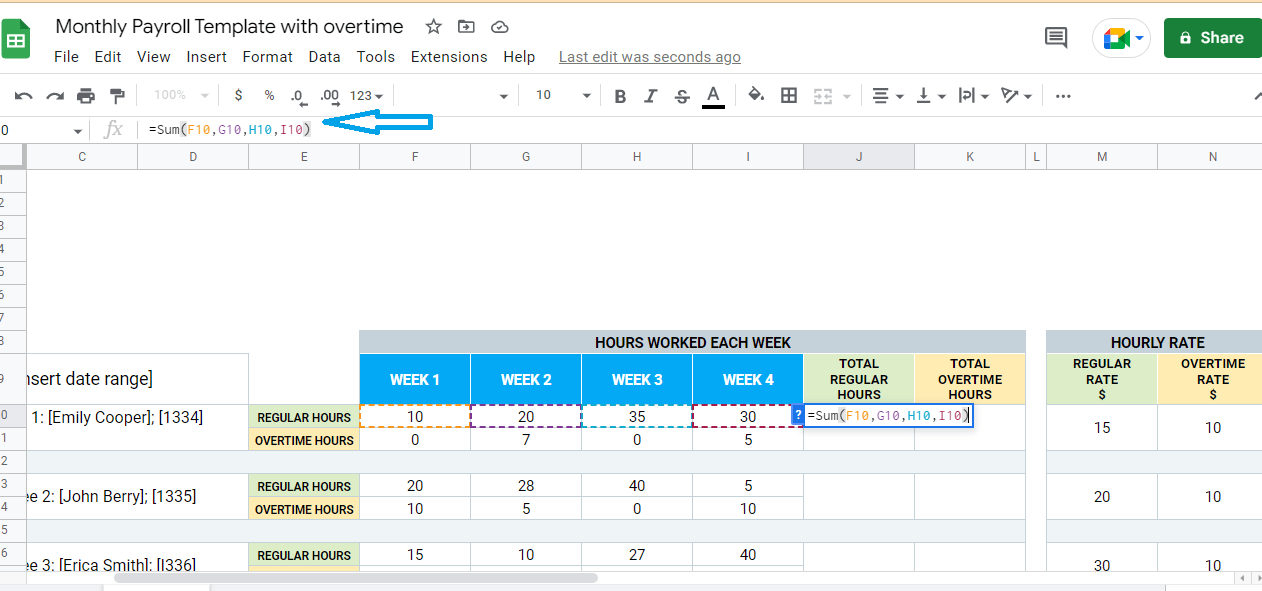

4. Use the SUM formula to calculate total regular hours.

Add four weeks’ working hours to find the total regular hours for the pay period (F10, G10, H10, and I10). Write this formula in the total regular hour cell and hit enter.

Formula =SUM(F10, G10, H10, I10)

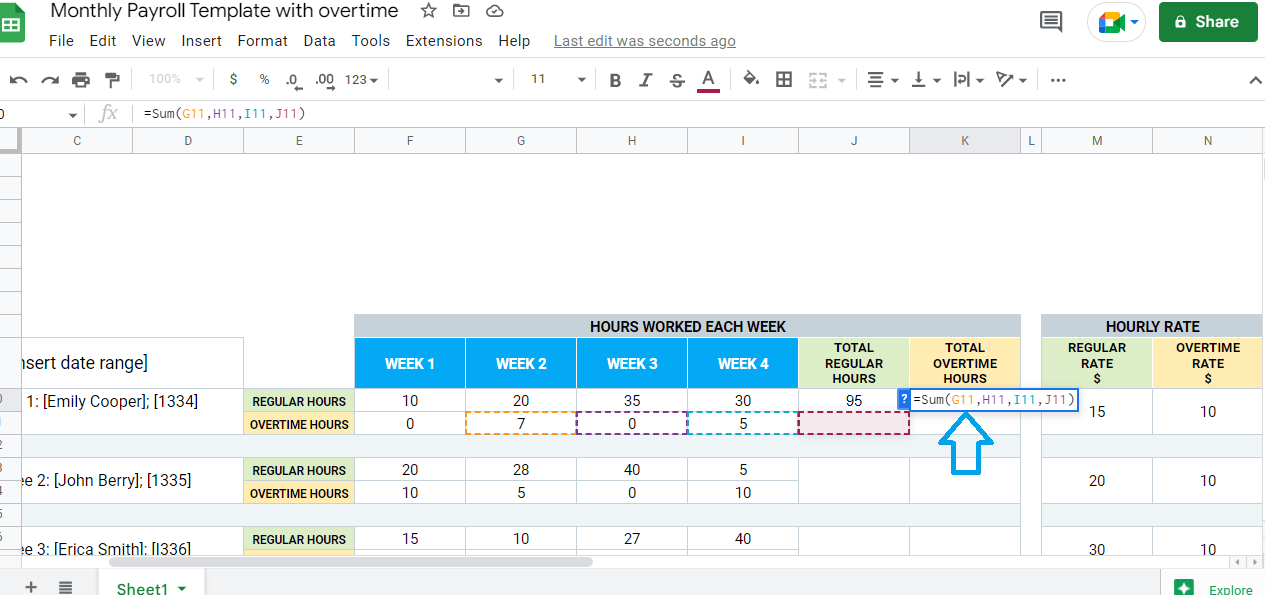

5. Use the SUM formula for the total overtime hours, using the overtime cells (F11, G11, H11, and I11).

Formula =SUM(F11, G11, H11, I11)

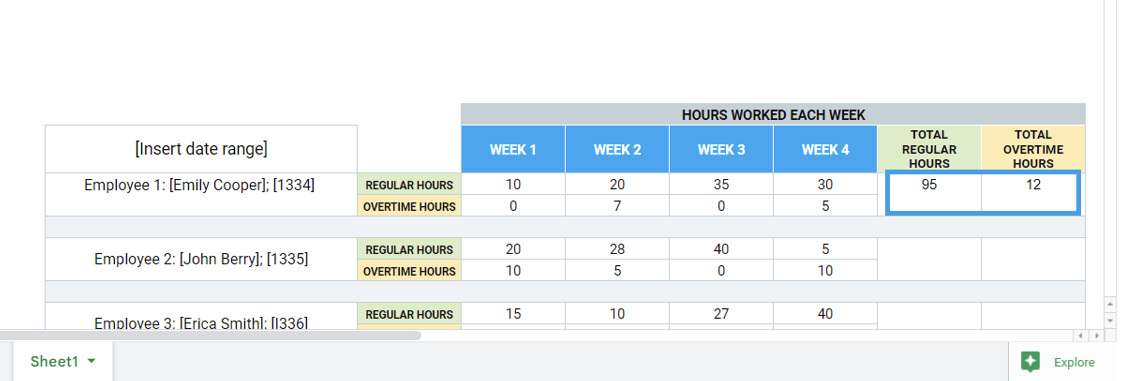

Here is the sum of the total regular hours and overtime hours.

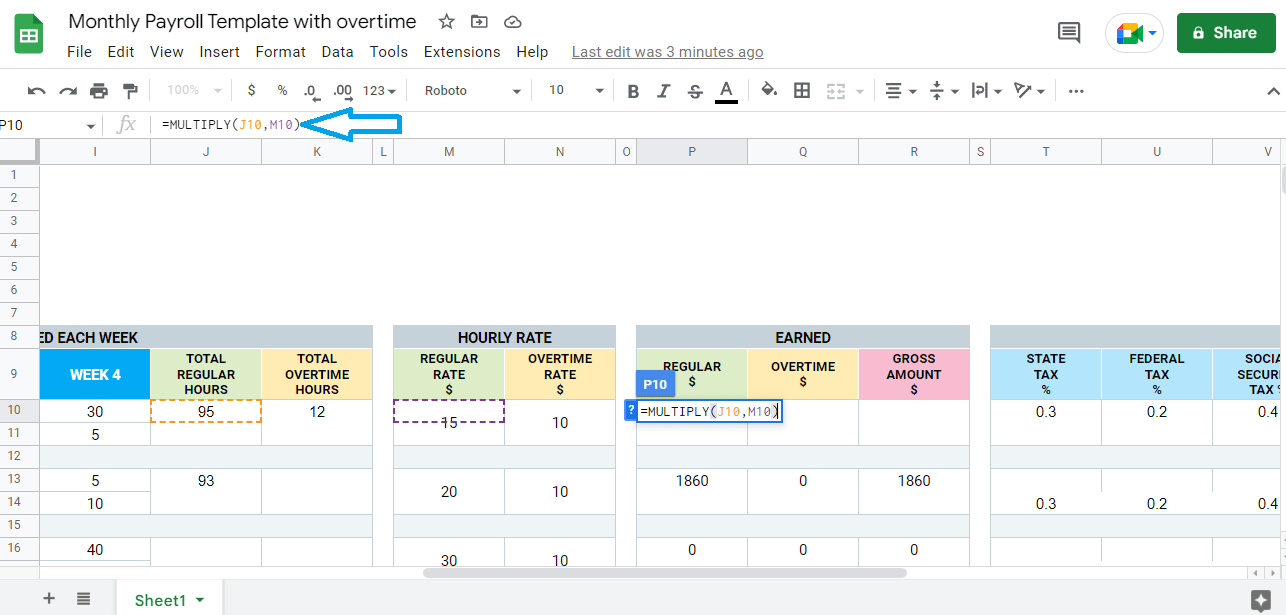

6. Use the MULTIPLY formula to calculate regular pay. Multiply the total regular hours by the regular rate to calculate regular pay. J10 contains the total regular hours, and M10 contains the regular hours rate.

Formula =MULTIPLY(J10, M10)

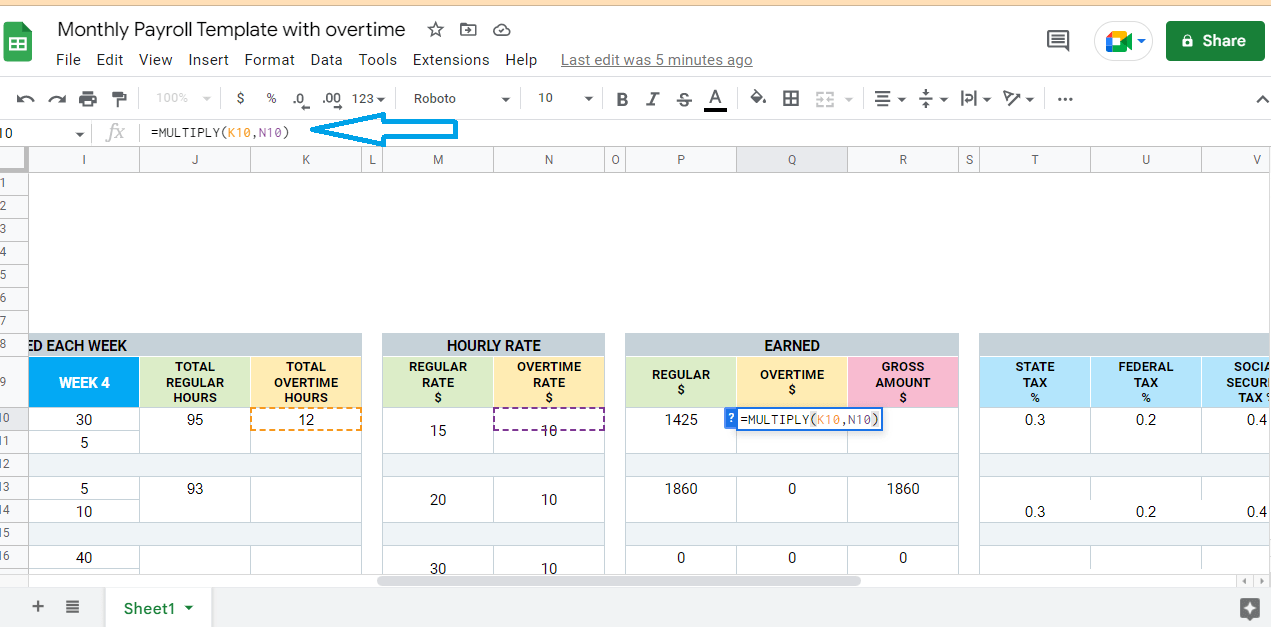

7. Calculate overtime pay. Use a similar MULTIPLY formula, only change the cell numbers used. K10 is the total overtime hours, and N10 is the overtime rate.

Formula =MULTIPLY(K10, N10)

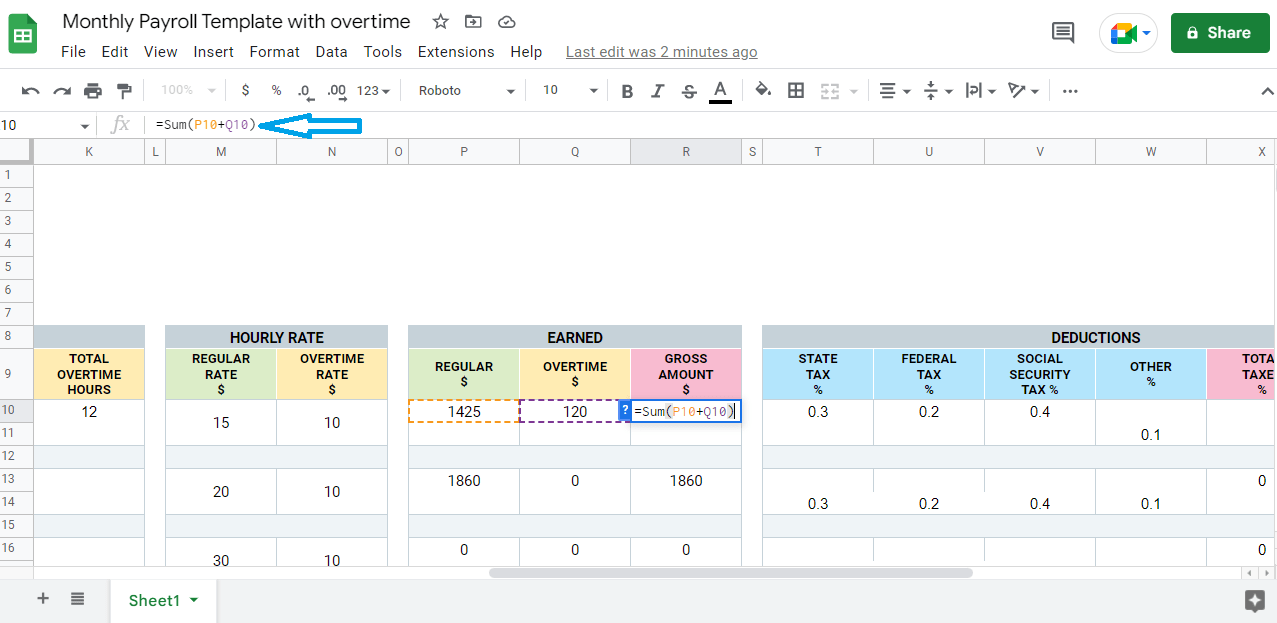

8. Calculate gross pay. Gross pay is the sum of regular pay and overtime pay. Add regular pay and overtime to get gross pay. P10 is regular pay, and Q10 is overtime pay.

Formula =SUM(P10, Q10)

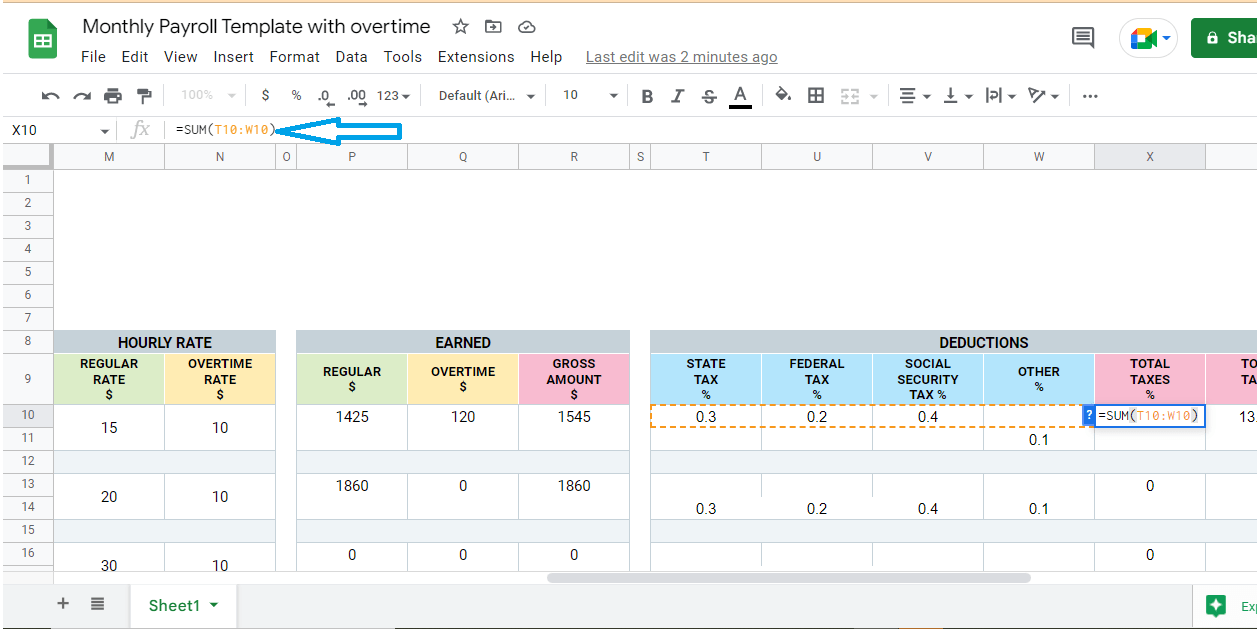

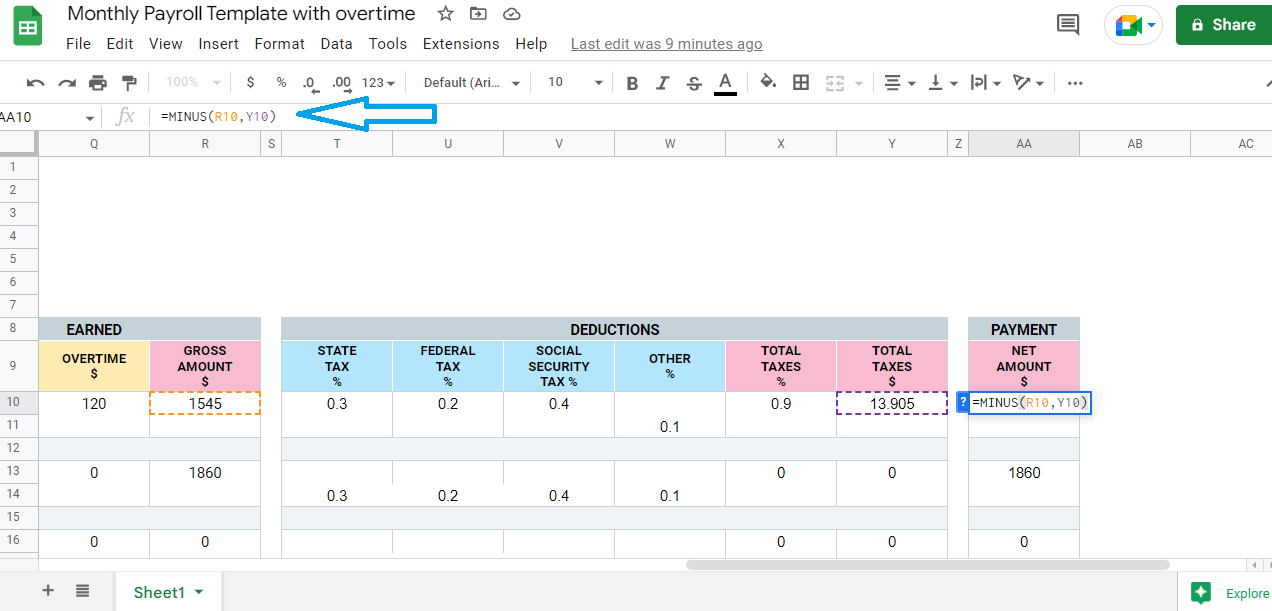

9. Calculate net pay. Net pay is gross pay minus deductions.

First, calculate all taxes. Use the SUM formula to calculate tax percentage. There are four tax cells. Use a colon (“:”) to add together a range of cells (in this case, T10 to W10).

Formula =SUM(T10:W10)

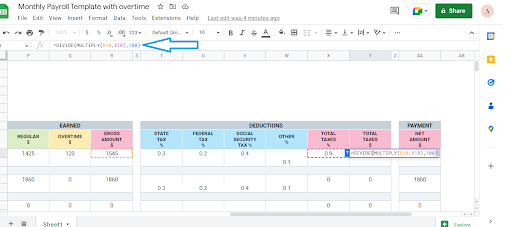

Next, calculate the tax amount using this formula. R10 is gross pay, and X10 is the total tax percentage.

Formula =DIVIDE(MULTIPLY(R10, X10),100)

10. In the end, calculate net pay by subtracting total taxes from gross pay. R10 is gross pay, and Y10 is the total amount of tax.

Formula =MINUS(R10, Y10)

Congratulations! You have successfully used your payroll template in Google Sheets.

Payroll Templates in Google Sheets: FAQs

Does Google Sheets have a built-in payroll template?

No, Google Sheets doesn’t have a built-in payroll template. But you can make your templates in Google Sheets or download templates from third parties.

How do I do payroll in Google Sheets?

To make a payroll template in Google Sheets, collect the data for your payroll. Then label the headers in your template with the employee name, hourly rate, total hours worked, taxes, gross pay, and net pay.

Enter the employee name, hourly rate, total hours, and taxes in their cells. Then use formulas to calculate pay.