Are you dreaming of a stress-free, financially secure retirement but unsure how to turn that dream into a reality? It’s never too early or too late to start planning for your golden years, and we are here to help you make that journey as smooth as possible.

Introducing our comprehensive list of the 17 Best Free Debt Retirement Planning Spreadsheets. These invaluable resources are designed to aid you in mapping out your financial future, whether you prefer Excel or Google Sheets.

These templates will allow you to manage your retirement savings, project your future income, and tackle any outstanding debt that could be standing in the way of your peaceful retirement. With these planning spreadsheets, you’ll be able to calculate your retirement needs, keep track of your progress, and make informed decisions about your financial future.

In this article, we will guide you through these well-designed, user-friendly templates and show you how to use them to their full advantage. Whether you’re just starting to save for retirement or you’re nearing retirement age, these spreadsheets are an essential tool for achieving financial security.

Quick Jump

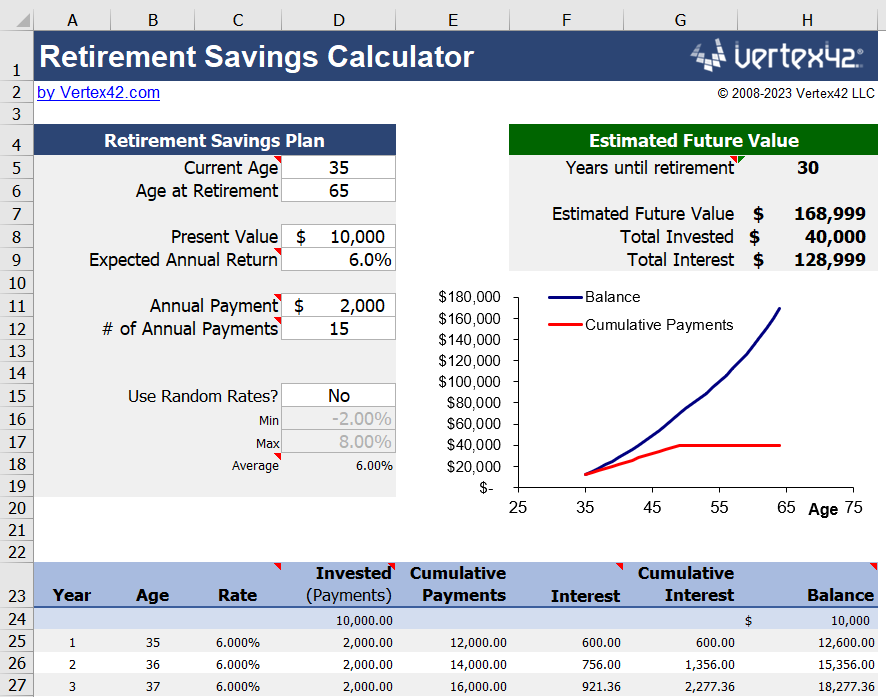

Toggle1. Retirement Planning Spreadsheet from Vertex for Excel

Platform: Microsoft Excel

Designed by Vertex42

Planning for retirement is a long-term commitment, but with the Retirement Planning Spreadsheet from Vertex for Excel, you can simplify the process. This template is designed to help you estimate the future value of your retirement savings based on your starting balance, expected interest rate, and annual investments. It even allows you to compare your total payments to the interest earned.

The template includes a feature to run simulations with random annual interest rates and a variable number of annual payments. This can provide a more realistic view of how your retirement savings might grow over time.

The Retirement Planning Spreadsheet from Vertex also includes comprehensive instructions on how to use the template, as well as a link to additional help resources. It’s a powerful ally in planning for your future, giving you the peace of mind that you’re on the right track toward a comfortable retirement.

We recommend this template because it makes the complex task of retirement planning more approachable. It provides a clear view of your potential financial future, helping you make informed decisions today that will benefit you in the years to come.

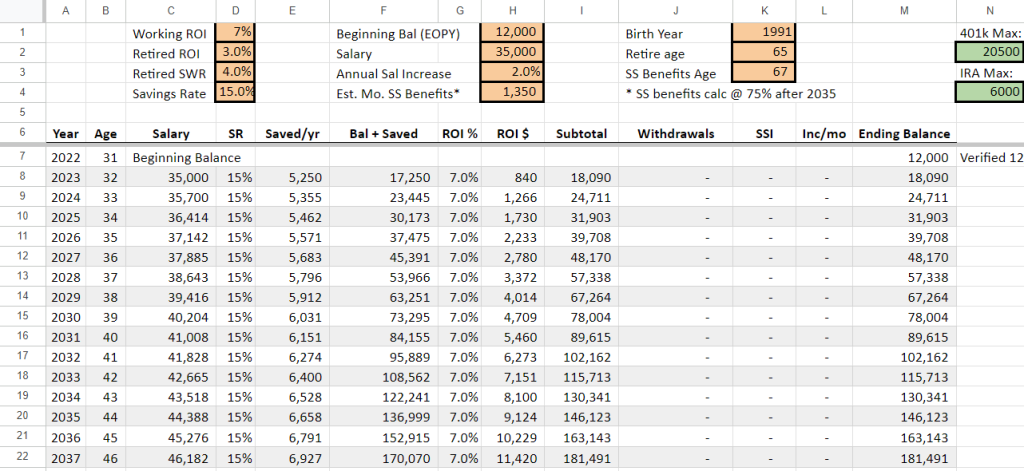

2. Retirement Planning Planner Spreadsheet from Reddit for Google Sheets

Platform: Google Sheets

Designed by Reddit

This Google Sheets template is a comprehensive solution for anyone planning for retirement. Developed by a Reddit user, this template is designed to help you easily forecast your retirement savings and understand how much you need to save to meet your retirement goals.

The template provides fields for various inputs like working and retired ROI, safe withdrawal rate, savings rate, salary, estimated social security benefits, and more. It also includes a SWR chart based on the Trinity Study for different stock/bond allocations. The template does not account for taxes, so you’ll need to adjust your figures accordingly.

The beauty of this template is that it allows you to make adjustments and immediately see the impact on your retirement plan.

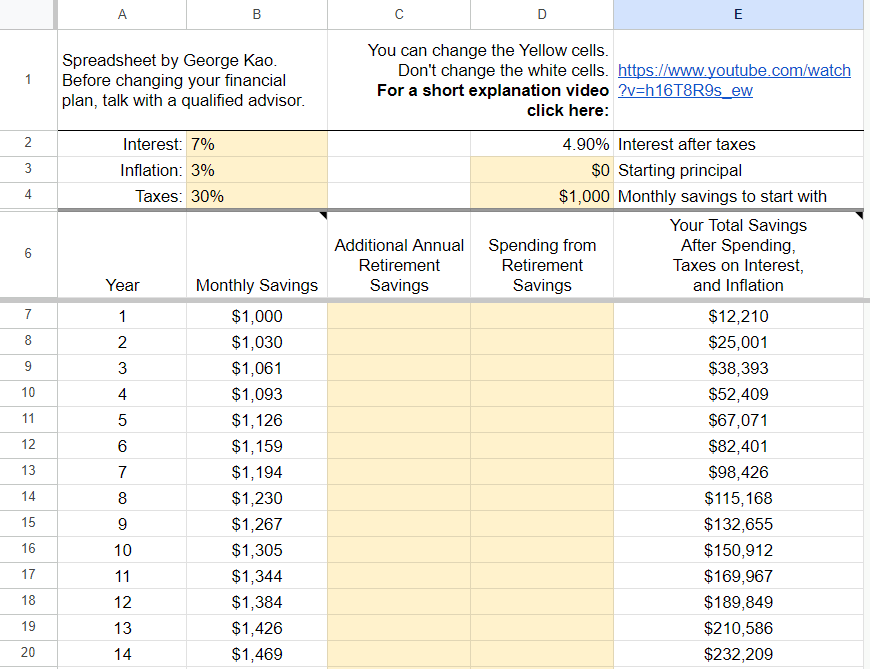

3. Simple Retirement Planning Spreadsheets for Google Sheets

Platform: Google Sheets

Designed by George Kao

The Simple Retirement Planning Spreadsheets by George Kao is a Google Sheets template designed to help you plan for your retirement in a straightforward and uncomplicated manner. This template not only allows you to calculate and visualize your savings over time, but it also considers factors such as interest rates, inflation, taxes, and your starting principal.

The template is easy to use – you simply input your data into the yellow cells, and the white cells will automatically update with your projected savings. This makes it a breeze to adjust your savings plan and see the potential impact on your retirement funds.

One of the standout features of this template is that it accounts for spending from retirement savings, which is often overlooked in other retirement planning templates. This gives you a more realistic view of your financial future.

On top of that, the template comes with a short explanatory video where George Kao guides you on how to use the template effectively. This can be particularly helpful for those who are new to financial planning.

We recommend this template because of its simplicity, comprehensiveness, and user-friendliness. It provides a realistic and holistic view of your retirement savings, taking into account various factors that can impact your financial future.

4. Couples Retirement Planning Spreadsheet from Medium for Google Sheets

Platform: Google Sheets

Designed by Medium

This Couples Retirement Planning Spreadsheet from Medium is designed to help couples plan their financial future together. It’s a comprehensive and detailed financial planning tool that enables you to track your income, investments, pensions, expenditures, and even make projections for the future. It provides a clear view of your current financial status, the progress you’re making, and what you need to do to reach your retirement goals.

What makes this template special is that it accounts for both partners’ financial situations, including separate income streams, investments, and expenditures. It also includes a retirement calculator, which can help you understand how much you need to save for your post-retirement years.

The template also comes with a changelog to keep track of amendments and updates. It’s a dynamic and interactive tool that can adjust to your changing financial circumstances.

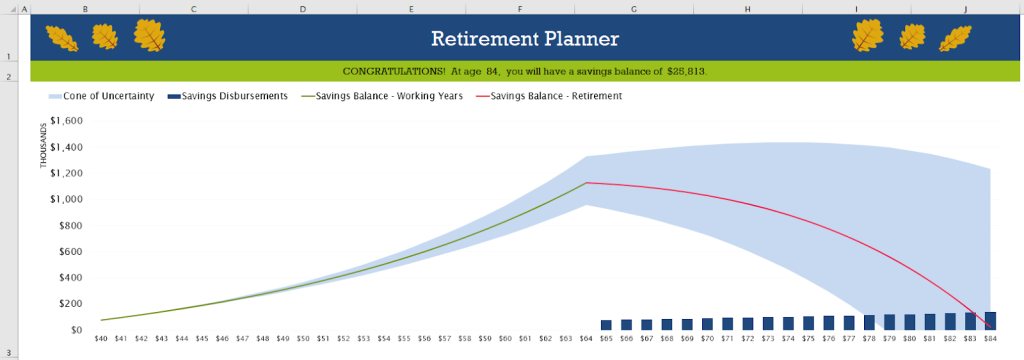

5. Retirement Spreadsheet Template from TechGuruPlus for Excel

Platform: Microsoft Excel

Designed by TechGuruPlus

The Retirement Spreadsheet Template from TechGuruPlus for Excel is a fantastic way to plan for your golden years. It goes beyond the simple savings strategy, offering an interactive and dynamic approach to retirement planning. Starting with your current age, annual income, and retirement savings balance, the template maps out your savings journey up to your desired retirement age.

The spreadsheet allows you to input several variables, including annual inflation and income increases, savings amount, and investment return percentages. It presents a detailed chart that visualizes your salary, balance, yearly savings, interest, and desired retirement income year by year. It also includes a built-in uncertainty calculator to account for variables like investment return uncertainty and annual savings amount uncertainty.

What sets this template apart is its ability to simulate various scenarios based on the inputs provided. It gives you a clearer understanding of how different factors affect your retirement savings and the potential outcomes of different savings and investment strategies.

This level of detail and customization makes it an invaluable resource for anyone serious about planning for retirement. We recommend this template for its comprehensive approach to retirement planning, taking into account multiple variables and uncertainties that can impact your financial future.

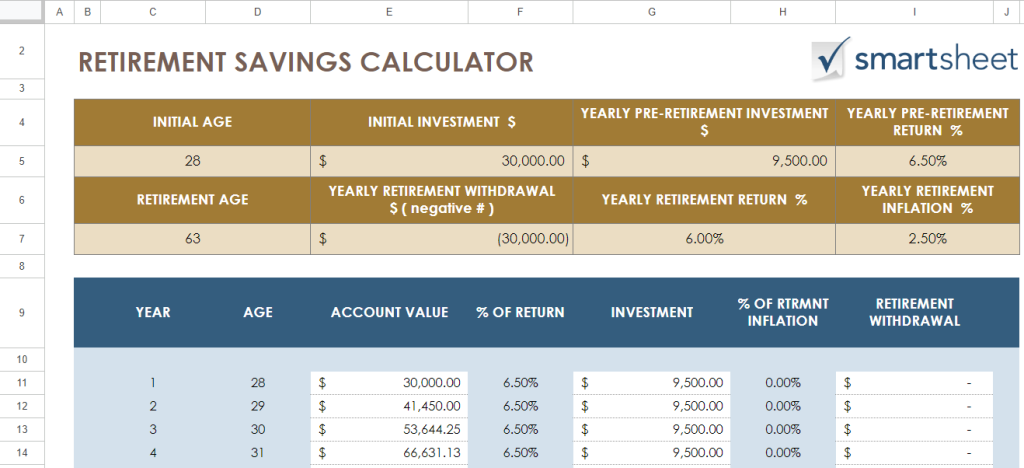

6. Retirement Spreadsheet Calculator from Smartsheet for Google Sheets

Platform: Google Sheets

Designed by Smartsheet

The Retirement Spreadsheet Calculator from Smartsheet for Google Sheets is a valuable resource for those planning their financial future. It’s designed to help you estimate your savings growth over time, allowing you to input variables such as your initial investment, yearly pre-retirement investment, yearly return, and retirement age.

This template is a dynamic model that can adapt to your changing financial situation. It allows you to simulate different scenarios and see the impact of various investment strategies. The template also includes a detailed table that illustrates how your retirement savings will grow year by year.

The beauty of this template is that it makes complex calculations simple, helping you to plan for a secure financial future.

7. Retirement Cash Flow Spreadsheet from Get Smarter About Money for Excel

Platform: Microsoft Excel

Designed by Get Smarter About Money

The Retirement Cash Flow Spreadsheet from Get Smarter About Money for Excel is designed to help you assess the feasibility of your retirement plans. It encourages you to consider your projected income from pensions and benefits, estimate your retirement expenses, and evaluate the potential performance of your investments.

It’s designed for annual updates, allowing you to refine your retirement plan as your financial situation evolves. It also accounts for factors such as inflation and unexpected expenses, providing a comprehensive outlook of your retirement finances. The detailed instructions guide you through the process, making it user-friendly even for those not well-versed in financial planning.

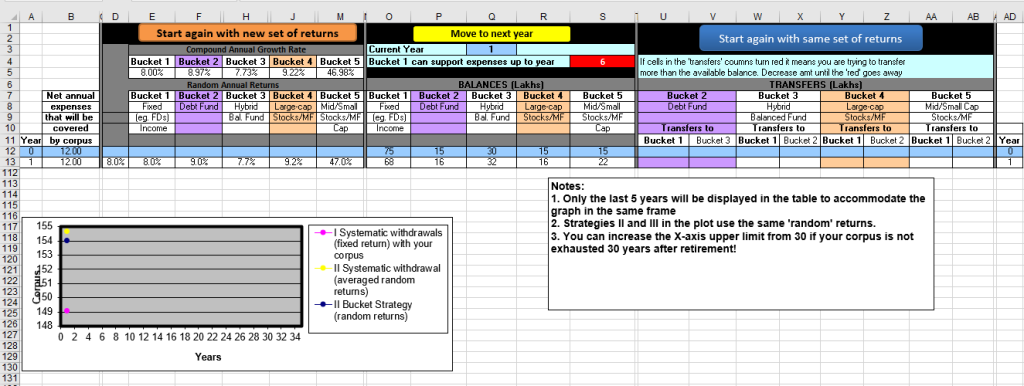

8. Retirement Bucket Strategy Spreadsheet from Freefincal.com for Excel

Platform: Microsoft Excel

Designed by Freefincal.com

This Retirement Bucket Strategy Spreadsheet from Freefincal.com is designed for those planning for their retirement. It’s a comprehensive Excel-based tool that helps you simulate different retirement scenarios based on your current financial situation and future expectations.

The template has sections for different types of investments, including fixed income, debt funds, balanced funds, and large and mid/small-cap stocks. It allows you to input your current monthly expenses, expected inflation rates, and desired retirement corpus. It also lets you specify the percentage allocation to each investment bucket and the average return and variation for each.

The spreadsheet then calculates the total corpus needed to meet expenses and simulates how long your retirement savings will last under different scenarios. It even gives you the option to try different withdrawal strategies to see if you can make your retirement corpus last longer.

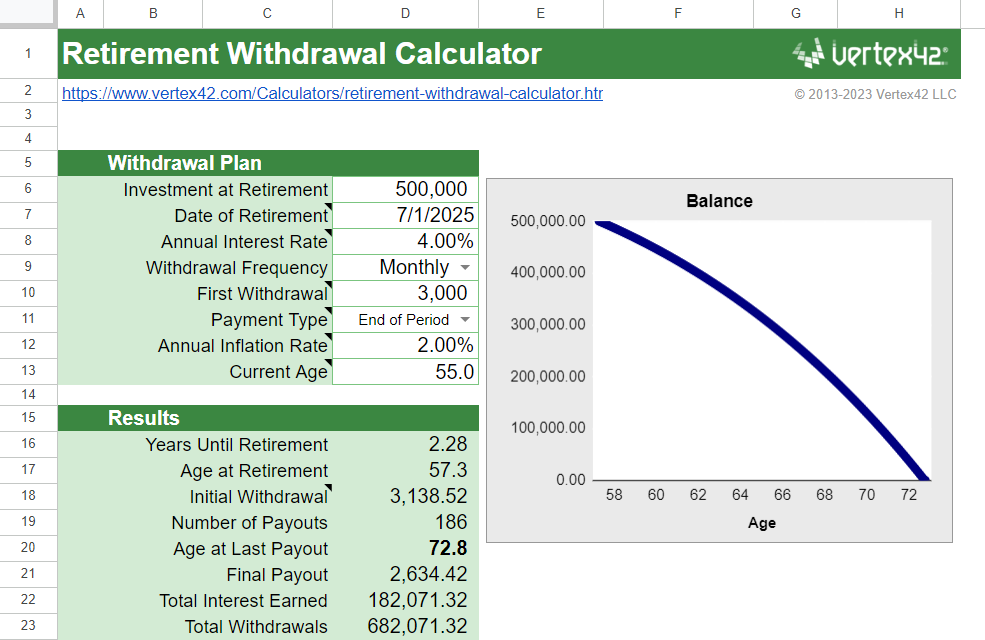

9. Retirement Withdrawal Calculator from Vertex42

Platform: Google Sheets & Microsoft Excel

Designed by Vertex42

Retirement planning can often seem like a daunting task, filled with uncertainty and what-ifs. The Retirement Withdrawal Calculator from Vertex42, however, brings clarity and simplicity to this process.

This template is designed to help you estimate how long your retirement savings might last. By inputting key variables such as your retirement date, annual interest rate, withdrawal frequency, and annual inflation rate, the calculator simulates a scenario where regular withdrawals are made from an account that earns a fixed interest rate. A detailed payout schedule is also included, providing a year-by-year breakdown of interest earned, withdrawal amounts, and remaining balance.

An additional feature allows for adjustments to the scheduled withdrawal amounts, providing flexibility in your retirement planning. While the calculator does not account for taxes, it serves as a great starting point for retirement planning.

10. Early Retirement Spreadsheet from Smartsheet for Excel

Platform: Microsoft Excel

Designed by Smartsheet

The Early Retirement Spreadsheet from Smartsheet for Excel is a must-have for anyone planning for early retirement. This comprehensive template assists you in planning your retirement income and expenses on a weekly, bi-weekly, monthly, quarterly, and annual basis. It takes into account various income sources such as Social Security income, company pensions, rental income, shares or investments income, annuity income, and other retirement plans.

The template also helps you budget for housing costs, personal expenses, daily living expenses, and even medical expenses. It provides a clear snapshot of your financial situation, helping you to understand how much you would need to retire comfortably. The template also includes an inflation budget, which estimates your annual income required at retirement and the total amount needed, taking into account an annual inflation rate.

What makes this template stand out is its thoroughness. It doesn’t just stop at the typical expenses but goes the extra mile to include categories like grooming, holidays, auto expenses, and even prescription drugs.

11. 401k Spreadsheet from Vertex42

Platform: Google Sheets & Microsoft Excel

Designed by Vertex42

The 401k Spreadsheet from Vertex42, available for Google Sheets and Microsoft Excel, is a comprehensive way to plan and monitor your retirement savings. It’s designed to help you track contributions, employer matches, and the overall growth of your 401k over time.

The calculator can be tailored to your specific situation by inputting your current age, years to invest, current 401k balance, and current annual salary. It also includes variables such as the percentage of salary to contribute, employer match, and annual rate of return. The template even provides detailed instructions and additional resources for financial calculators, retirement calculators, and budgeting templates.

It’s a great way to visualize the power of compound interest and the importance of consistent contributions over time. This template is a must-have for anyone who wants a clear and detailed understanding of their retirement savings journey.

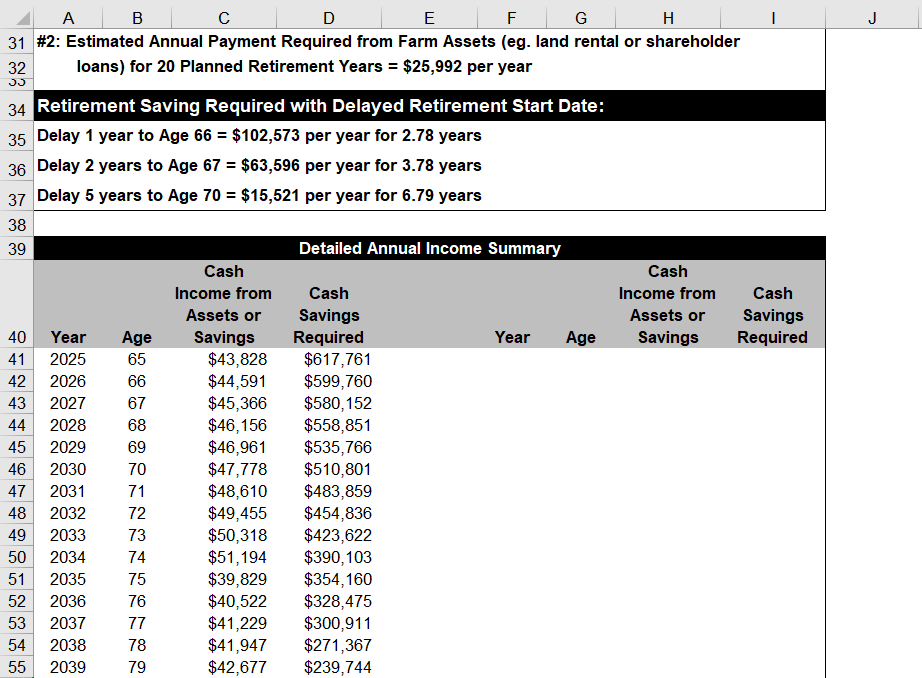

12. Retirement Income Calculator Spreadsheet from Province of Manitoba for Excel

Platform: Microsoft Excel

Designed by Province of Manitoba

If you’re planning for retirement, the Retirement Income Calculator Spreadsheet from Province of Manitoba for Excel can be a game-changer. This detailed Microsoft Excel template allows you to project your retirement income, savings, and assets.

With this template, you can plan your retirement income for two periods, each lasting ten years, and adjust for an annual inflation index rate. Furthermore, it allows you to calculate your estimated Canada Pension Plan and other pension plans. The template also provides an analysis of your retirement savings, indicating if there is a shortfall and offering planning options.

You can even plan for a delayed retirement start date. The final part of the template offers a detailed annual income and savings summary. We highly recommend this template because it offers a comprehensive and personalized approach to retirement planning, ensuring that you can make financially sound decisions for your future.

13. FIRE Spreadsheet from Reddit for Google Sheets

Platform: Google Sheets

Designed by Reddit

Are you on the path to financial independence and early retirement (FI/RE)? This Google Sheets template, sourced from the Reddit community, can be your new best friend. It’s a comprehensive FI/RE calculator that helps you visualize your financial journey over the years.

The template is designed to track your net worth, income, spending, savings, and more. You’ll be able to see your financial progress and project when you’ll reach your FI/RE goal. The calculator also includes fields for variables like annual income increases and return on investments.

One of the standout features is the ‘Age to FI/RE’ and ‘FI/RE in Year’ fields, which give you a realistic timeline for reaching your financial goals. You can also see how much you could withdraw yearly and monthly if you retire now.

This template emphasizes the importance of your savings rate over your return on investment. It’s a testament to the saying, “It’s not about how much you earn, but how much you save.”

The reason we recommend this template is because it gives you a clear and detailed overview of your financial journey.

14. Retirement Planning Worksheet from Money for the Rest of Us for Excel

Platform: Microsoft Excel

Designed by Money for the Rest of Us

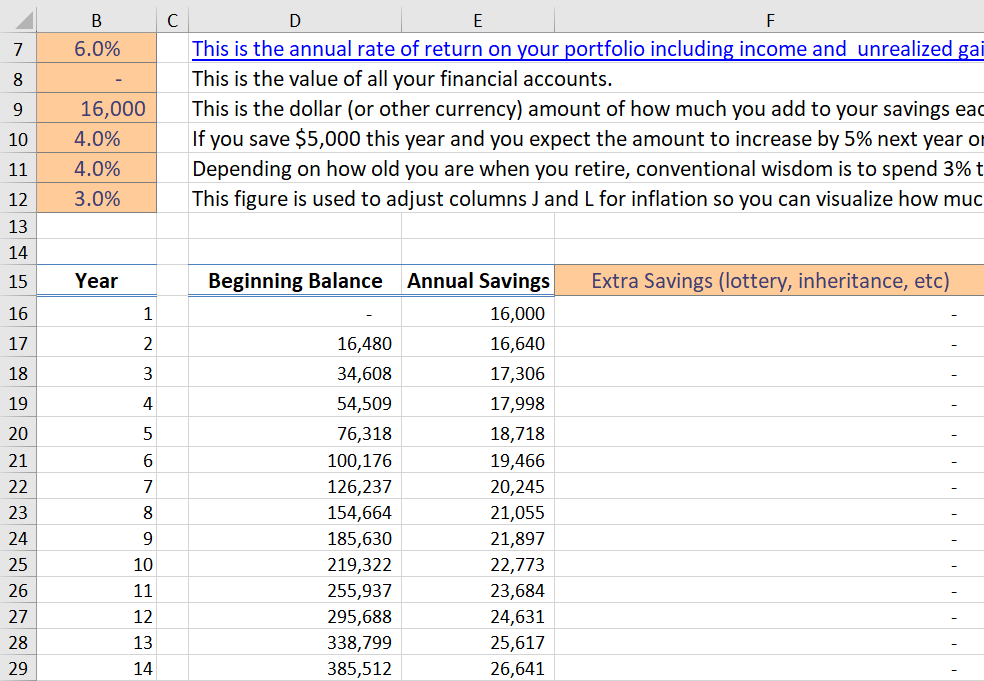

Wondering if you’re saving enough for retirement? This retirement planning worksheet from Money for the Rest of Us for Excel is just the companion you need. It’s designed to give you a clear picture of your financial future. You’ll input your current savings balance, annual savings amount, and expected annual return for your investment portfolio.

The spreadsheet also factors in the percentage increase of your savings each year, the percentage of your portfolio you plan to spend in your first year of retirement, and the expected inflation rate. It even allows for adjustments such as extra savings windfalls or one-time expenses.

The end result is a detailed projection of your financial health upon retirement, including your ending balance in today’s dollars and the annual amount you could spend if you retired in any given year.

We recommend this template because it takes the guesswork out of retirement planning. It’s comprehensive, easy to use, and gives you the information you need to make informed decisions about your future.

15. Long Term Financial Planning Spreadsheet from Smartsheet for Google Sheets

Platform: Google Sheets

Designed by Smartsheet

The Long Term Financial Planning Spreadsheet from Smartsheet for Google Sheets is a comprehensive and detailed spreadsheet designed to help you plan your finances on a monthly basis.

This template provides the option to input income and expenses for each month, broken down into numerous categories such as housing, utilities, personal, food, transportation, and others. This way, you can easily monitor your financial situation throughout the year.

It also features a Year-to-Date (YTD) income and expenses overview to help you keep track of your total earnings and spending. What sets this template apart is its detailed and meticulous layout, allowing for a thorough and in-depth financial analysis.

This is highly recommended for those who prefer a detailed and long-term approach to financial planning.

16. Monthly Retirement Planning Worksheet from Smartsheet for Excel

Platform: Microsoft Excel

Designed by Smartsheet

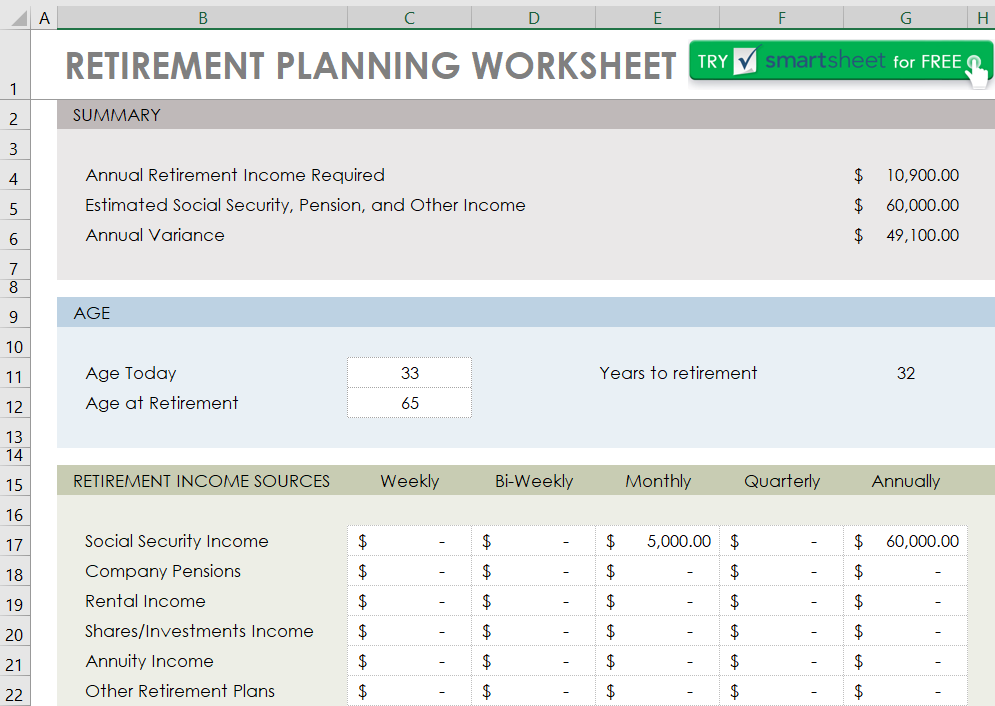

Planning for retirement can feel daunting, but the Monthly Retirement Planning Worksheet from Smartsheet for Excel is here to simplify the process. This Google Sheets template is designed to help you understand your financial situation now and predict how it will look when you retire.

It starts with a summary section that gives you a quick overview of your annual retirement income requirements, estimated Social Security, pension, and other income sources, and the variance between them. It then provides a detailed breakdown of your retirement income sources, including Social Security, company pensions, rental income, shares or investments, annuity income, and other retirement plans.

Next, it dives into your housing costs, including mortgage or rent, real estate taxes, maintenance and repair, and home insurance. It also provides sections to input your personal expenses and daily living expenses, which include everything from grooming to groceries.

Finally, it takes into account your medical expenses, such as prescription drugs and medical insurance. It’s a comprehensive look at your financial landscape, which allows you to plan your retirement accurately.

17. Monte Carlo Retirement Calculator from Freefincal for Excel

Platform: Microsoft Excel

Designed by Freefincal

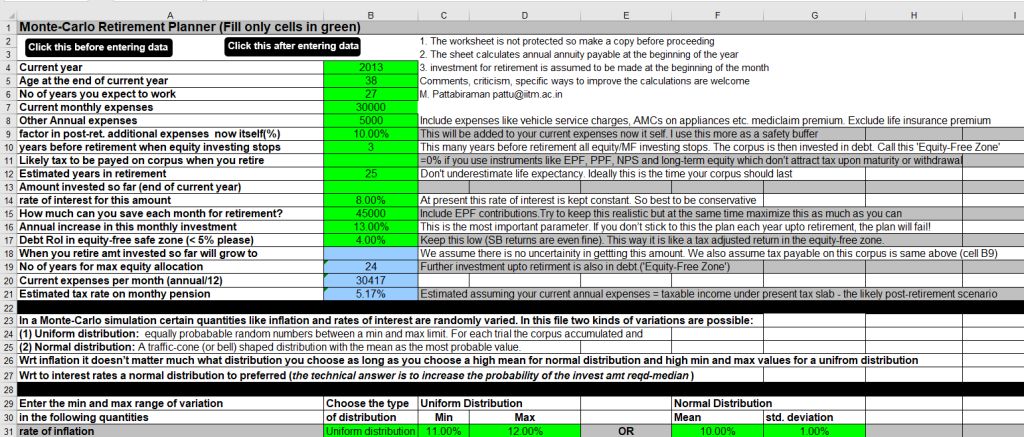

The Monte Carlo Retirement Calculator from Freefincal for Excel is a unique financial planning resource. It’s designed to help you prepare for the uncertain future by simulating potential scenarios. Rather than just assuming a fixed inflation rate and interest rate, this calculator “gambles” with these rates.

It randomly varies these rates through 50,000 trials to calculate the most probable number of years a retirement corpus will last based on the amount you can save. This dynamic feature offers a more realistic perspective on your retirement planning. It even provides a suggested savings amount to increase the chances of your retirement corpus lasting your lifetime. The calculator is user-friendly, with clear instructions for ease of use.

We recommend this template because it provides a more comprehensive and realistic approach to retirement planning, considering the unpredictability of inflation and interest rates. It’s like having a personal financial advisor that helps you prepare for various financial scenarios.