Easily document your charitable contributions with our free Donor Receipt Template.

Available in Google Sheets, Excel, Word, Google Docs, and PDF, this template is fully editable and designed to keep your donation records clear and professional.

Explore our full library of free customizable receipt templates for all your nonprofit and fundraising needs.

Quick Jump

ToggleWhat Is a Donor Receipt Template?

A donor receipt template is a pre-formatted document that nonprofit organizations use to acknowledge and provide written proof of donors’ charitable contributions.

This standardized template helps nonprofits efficiently issue IRS-compliant receipts while ensuring donors have the documentation needed to claim tax deductions for their charitable giving.

Download Spreadsheet Daddy’s Free Donor Receipt Template

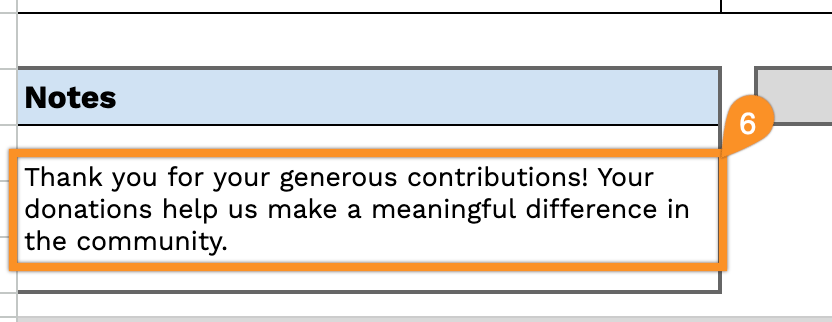

Our Donation Receipt Template provides a clear, professional format for documenting charitable contributions and thanking donors for their support.

What’s included

- Customizable charity information fields: The header section includes editable placeholders for charity name, email address, physical address, and phone number, allowing you to quickly brand the receipt with your organization’s details for professional documentation and compliance with tax requirements.

- Comprehensive donor information section: Dedicated fields capture the donor’s name, address, email, and phone number, ensuring complete contact records for acknowledgment letters, future fundraising communications, and IRS documentation requirements.

- Itemized donation tracking table: A table with columns for Description, Quantity, Unit Cost, and Amount enables detailed recording of multiple donations, whether cash contributions, in-kind gifts, or goods, with clear line-item breakdowns for accurate valuation and reporting.

- Receipt identification and total calculation fields: The template includes a Receipt Number field for tracking and reference, a Date field for recording the donation date, and a Total Amount field that summarizes the donation amount for tax deduction purposes.

- Professional formatting with notes section: A clean, printer-friendly layout features well-spaced text and clear section headers, plus a dedicated Notes area for adding tax-deductible statements, IRS disclaimers, or personalized thank-you messages, concluding with a courteous “Thank you for your support!” acknowledgment.

You can customize it by adding or removing columns to fit your organization’s specific tracking and reporting needs.

Choose your favorite format and download a free blank donor receipt template from the links below:

How to Use Our Donor Receipt Template

1. Access this donor receipt template in Excel, Word, or PDF, or make your own version in Google Sheets or Docs.

2. At the top of the template, include your charity’s name, email, address, phone number, and logo.

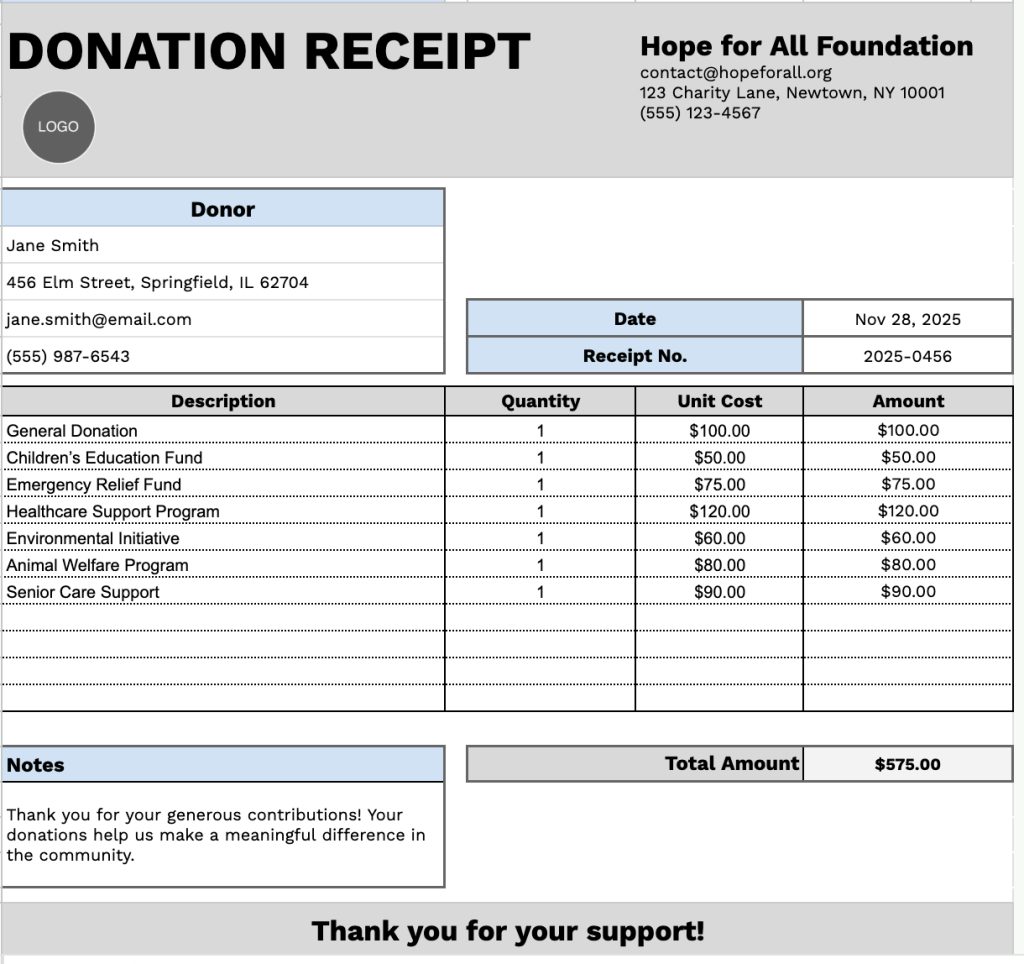

3. Add the donor’s name, contact information, the date of donation, and the receipt number.

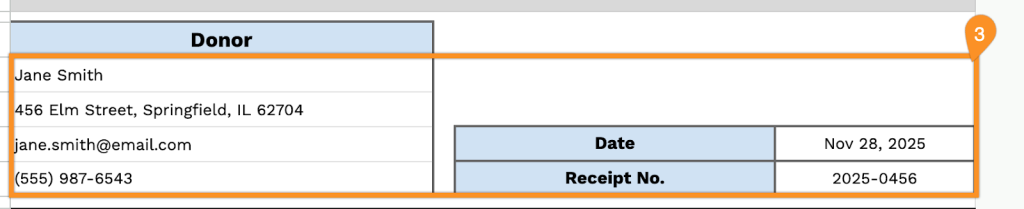

4. Specify the items supplied, including quantity and price. The template will automatically calculate the total for each line.

5. The template will calculate the total donation amount.

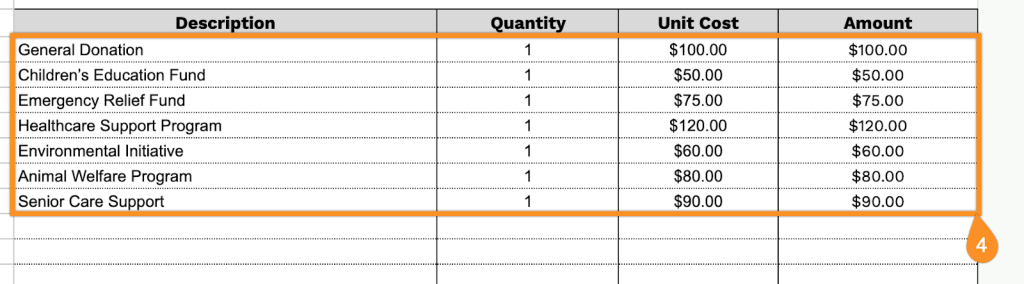

6. Use the Notes section for any important details or special messages.