Simplify your record-keeping for non-cash contributions with our free In-Kind Donation Receipt Template.

Available in Google Sheets, Excel, Word, Google Docs, and PDF, this template is fully editable, allowing you to document donations for donors and tax purposes accurately.

Explore our full library of free customizable receipt templates for every donation type.

Quick Jump

ToggleWhat Is an In-Kind Donation Receipt Template?

An in-kind donation receipt template is a standardized document used by nonprofits and charitable organizations to acknowledge non-monetary contributions, such as goods, services, or volunteer time.

Unlike cash donation receipts, in-kind receipts usually do not include a monetary valuation, as IRS regulations require donors to determine the fair market value themselves for tax deduction purposes.

Download Spreadsheet Daddy’s Free In-Kind Donation Receipt Template

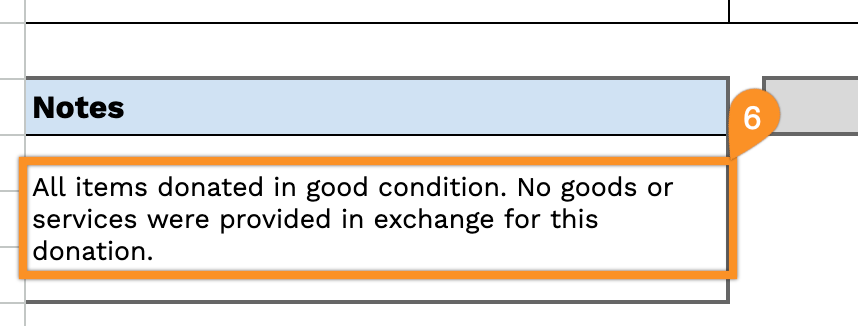

Our In-Kind Donation Receipt Template provides a clear and organized format for documenting non-monetary contributions to your organization.

What’s included

- Customizable organization information fields: The header section includes editable placeholders for company name, email address, physical address, and phone number, allowing you to quickly brand the receipt with your nonprofit or business details for professional documentation.

- Complete donor information section: Dedicated fields capture essential donor details, including name, address, email, and phone number, along with date and receipt number fields, ensuring proper record-keeping and providing donors with official documentation for tax deduction purposes.

- Itemized donation table with eleven rows: A structured table featuring four columns (Description, Quantity, Unit Cost, and Amount) with pre-formatted line items, enabling you to list multiple donated goods or services with their corresponding values for accurate in-kind contribution tracking.

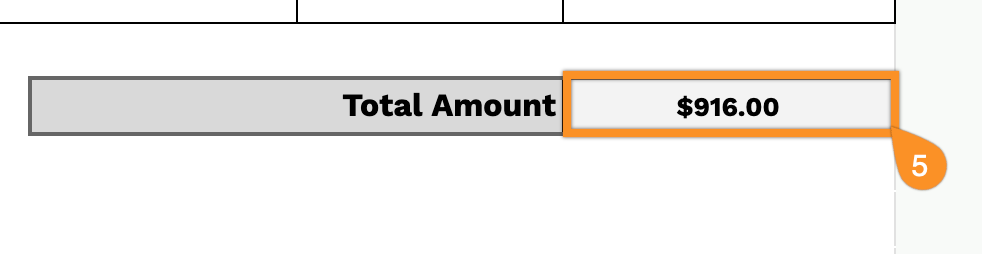

- Automatic amount calculation fields: Each row includes an Amount column that displays the individual line-item total based on quantity and unit cost, with all values feeding into a prominent Total Amount summary box at the bottom for clear financial documentation.

- Notes section with appreciation message: A dedicated notes area below the itemized table allows you to add tax-exemption information, donation restrictions, special acknowledgments, or other relevant details, followed by a courteous “Thank you for your support!” message to express gratitude for the donor’s generosity.

Customize it by adding or removing columns to match your specific documentation requirements.

Select your preferred format and get a free blank in-kind donation receipt template from the links below:

How to Use Our In-Kind Donation Receipt Template

1. Get your in-kind donation receipt template available in Excel, Word, or PDF, or make a custom copy in Google Sheets or Docs.

2. Enter your company information at the top, including your company name, email, address, phone number, and logo.

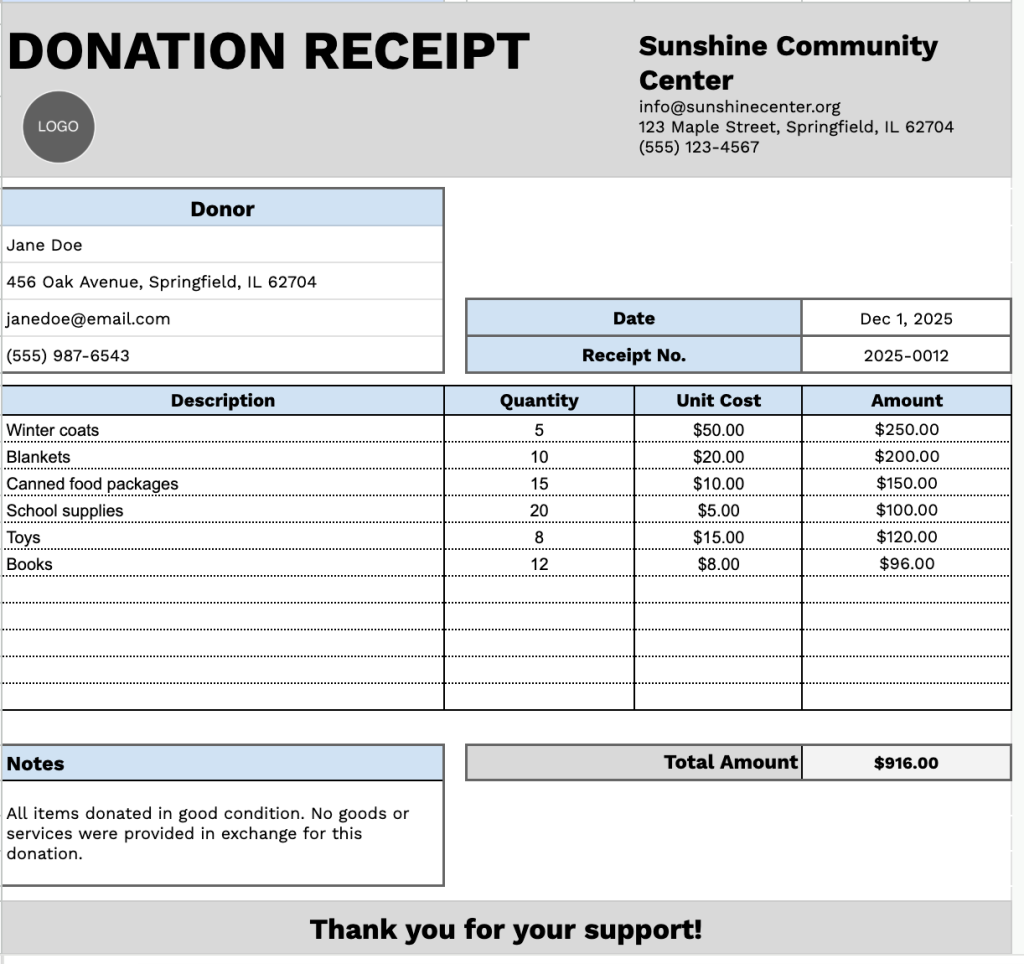

3. Fill in the donor’s information, along with the date of the donation and the receipt number.

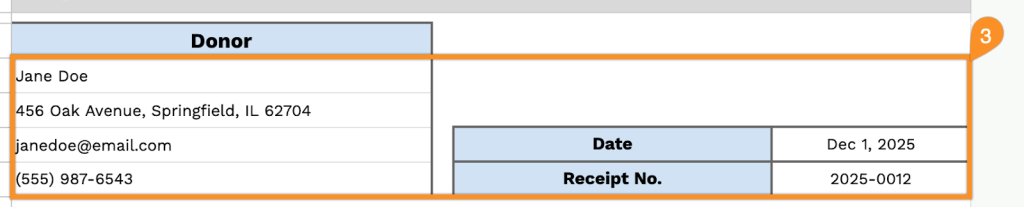

4. List the donated items, specifying the quantity and estimated value for each. The template will automatically calculate the total for each line.

5. The template will automatically calculate the overall total value of the donation.

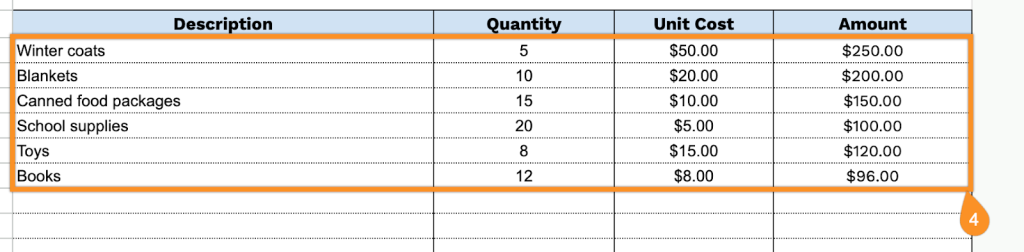

6. Use the Notes section to include any additional details, special instructions, or acknowledgments.