Understanding your business finances starts with knowing what you own and what you owe. A monthly balance sheet provides exactly that: a clear snapshot of your company’s financial position at a specific point each month.

Whether you’re managing a startup, running a small business, or overseeing nonprofit finances, maintaining monthly balance sheets is essential for monitoring trends and catching issues early.

The challenge is that creating one from scratch can be time-consuming and intimidating if you’re not familiar with accounting principles.

That’s where a ready-made template comes in. Download our free monthly balance sheet template and start tracking your financial position today.

Quick Jump

ToggleWhat Is a Monthly Balance Sheet Spreadsheet?

A monthly balance sheet spreadsheet is a financial document that tracks a company’s assets, liabilities, and equity at the end of each month, providing a snapshot of its financial position.

This tool helps businesses monitor their financial health over time, identify trends, and make informed decisions about resource allocation and financial planning.

Download Spreadsheet Daddy’s Free Monthly Balance Sheet Spreadsheet

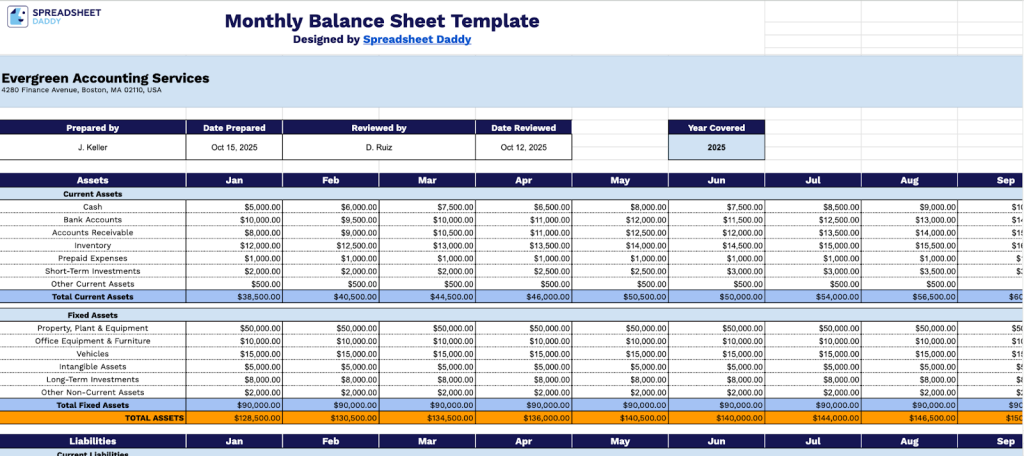

Our Monthly Balance Sheet Template helps you track your company’s financial health throughout the year.

You can easily customize the template by adding or removing rows to match your specific business needs and accounting structure.

What’s included

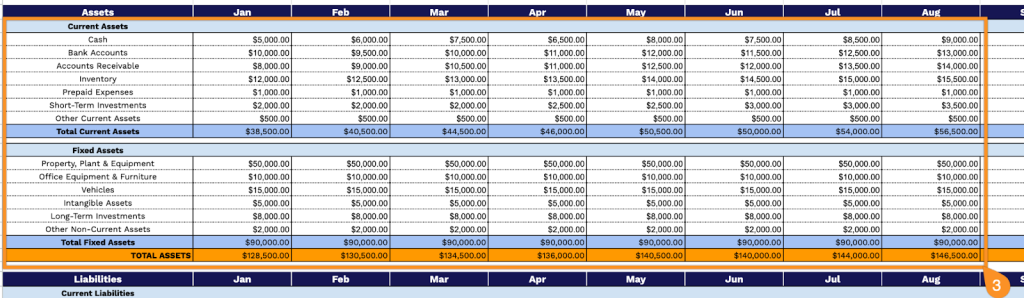

- Comprehensive monthly tracking across all 12 months: The template features dedicated columns for January through December, plus a Year-to-Date (YTD) summary column. This allows you to monitor your company’s financial position month over month and identify seasonal trends or significant changes in your balance sheet throughout the year.

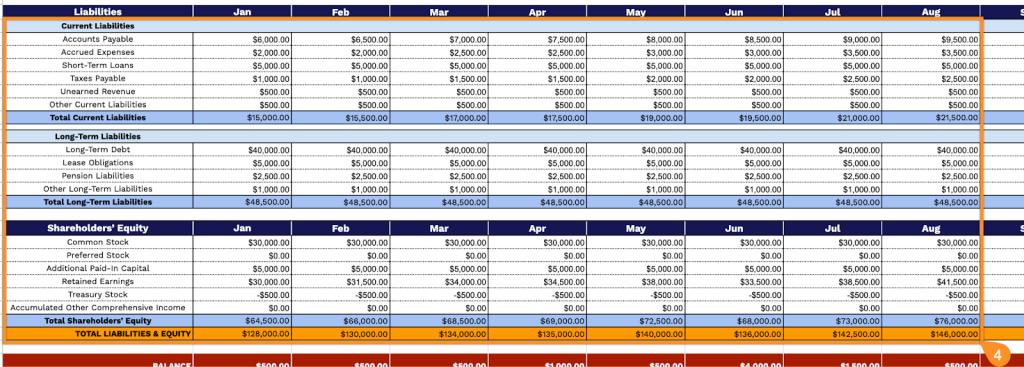

- Three-part financial structure following standard accounting principles: Organized into Assets, Liabilities, and Shareholders’ Equity sections. Assets are subdivided into Current Assets and Fixed Assets. Liabilities are split into Current and Long-Term categories for precise tracking of obligations.

- Pre-formatted currency fields with automatic totaling: All monetary values display in standard currency format, with subtotal rows that automatically calculate category totals. The template includes Total Current Assets, Total Fixed Assets, Total Current Liabilities, Total Long-Term Liabilities, and Total Shareholders’ Equity rows that roll up into master totals.

- Professional documentation header with customizable fields: The top section includes spaces for Company Name, Address, Prepared By, Date Prepared, Reviewed By, Date Reviewed, and Year Covered. This ensures proper attribution and creates an audit trail for financial reporting and internal review processes.

- Built-in balance verification system: A dedicated Balance row at the bottom automatically checks that Total Assets equals Total Liabilities and Equity across all months. This real-time verification ensures your balance sheet remains mathematically accurate and helps catch data entry errors immediately.

How to Use Our Monthly Balance Sheet Spreadsheet Template

1. To begin tracking your monthly financial position, download this balance sheet template as an Excel or PDF file, or create a copy in Google Sheets.

2. Enter your organization’s name, location details, and the person who compiled the document, along with when it was completed. Include the reviewer’s name, review date, and the fiscal year being reported.

3. Record your asset values month by month in the designated Assets area. Subtotals and total assets are automatically calculated with each entry.

4. Continue by filling in the Liabilities and Shareholder’s Equity segments. As you enter monthly amounts for each entry, the template automatically calculates total liabilities and equity.

5. Ultimately, each month’s balance will be determined using all the financial information you’ve provided.