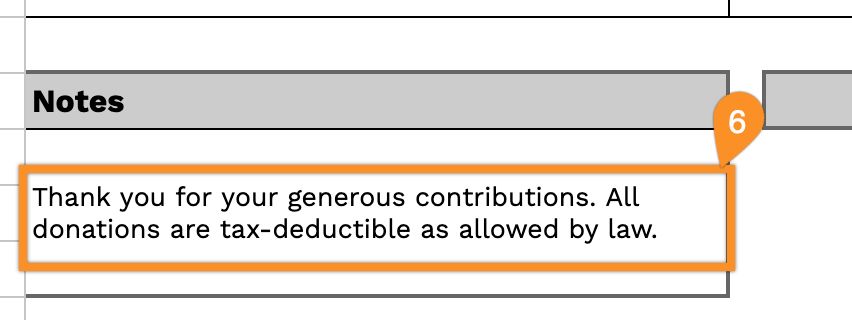

Ensure your donations are documented adequately with our Tax Donation Receipt Template.

Professionally designed and easy to edit in Excel, Google Sheets, Word, Google Docs, or PDF, this template helps you maintain accurate records for tax reporting.

Explore our full library of free receipt templates for all your documentation needs.

Quick Jump

ToggleWhat Is a Tax Donation Receipt Template?

A tax donation receipt template is a standardized document that charitable organizations use to acknowledge and record monetary or in-kind donations from contributors.

It provides donors with official proof of their charitable giving, which they can use to claim tax deductions when filing their income tax returns.

Download Spreadsheet Daddy’s Free Tax Donation Receipt Template

Our Tax Donation Receipt Template provides a clean, professional format for documenting charitable contributions.

What’s included

- Customizable organization information fields: The header section includes editable placeholders for company name, email address, physical address, and phone number, allowing you to quickly brand the receipt with your nonprofit or organization details for professional documentation and donor correspondence.

- Comprehensive donor details panel: The “Bill To” section captures complete recipient information, including name, email, physical address, and phone number, along with essential tracking fields for receipt date, receipt number, and payment method to ensure proper record-keeping and IRS compliance.

- Itemized donation breakdown table: A structured four-column table (Description, QTY, Unit Cost, Amount) with pre-formatted rows enables you to list multiple donated items or monetary contributions with quantities and individual values, with each line automatically calculating the item-specific amount for transparent reporting.

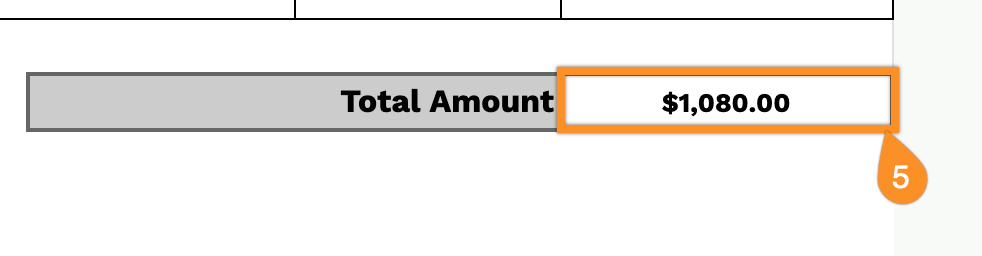

- Automated total calculation field: The financial summary section features a dedicated total amount field that aggregates all itemized donations in standard accounting format, providing clear documentation of the complete donation value for tax deduction purposes and organizational records.

- Customizable notes section with appreciation message: A flexible notes field allows you to add tax-exempt status information, donation restrictions, or special acknowledgments, complemented by a pre-formatted “Thank you for the support!” message that reinforces donor appreciation and can be personalized to match your organization’s tone.

The flexible design allows you to easily add or remove columns to match your organization’s specific tracking needs.

Choose your preferred format and download a free blank tax donation receipt template from the links below:

How to Use Our Tax Donation Receipt Template

1. Access this tax donation receipt template and save it as Excel, Word, or PDF, or duplicate it in Google Docs or Sheets.

2. Enter your organization’s details at the top, including the name, email, address, phone number, and logo.

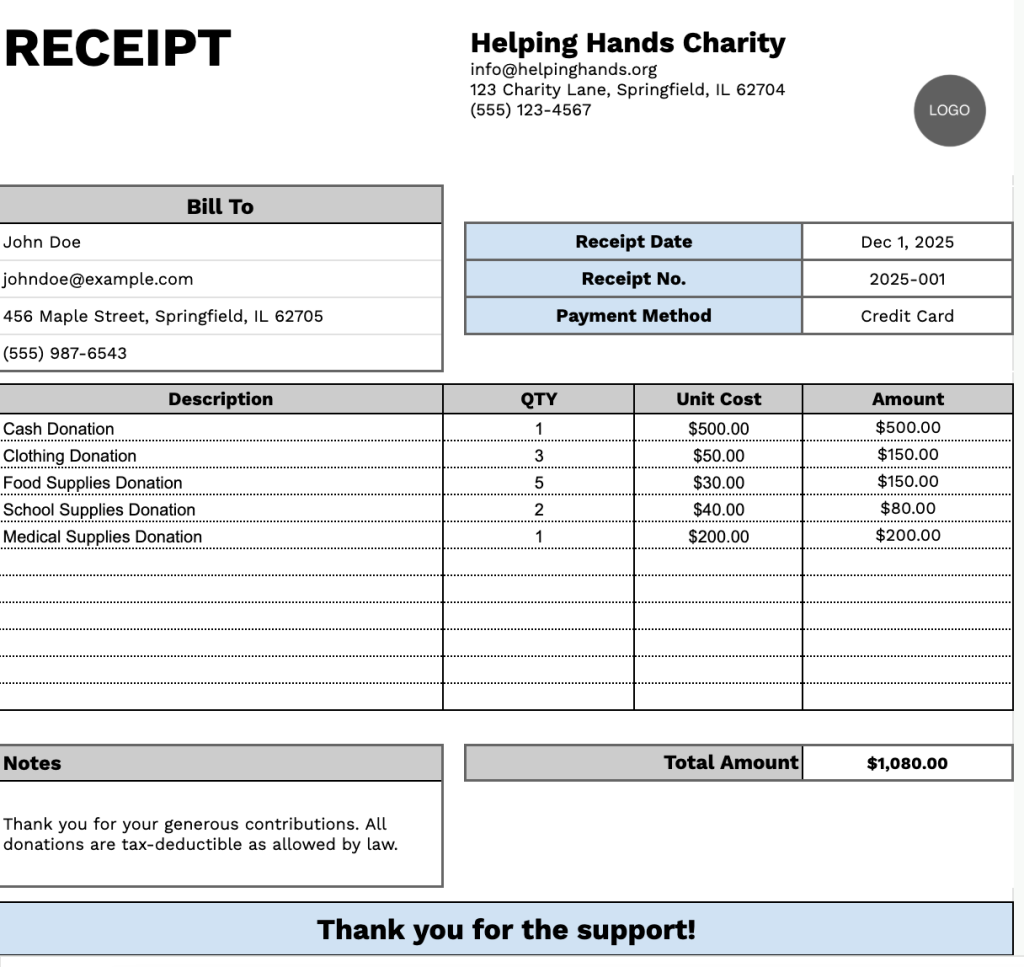

3. Complete the “Bill To” section with the donor’s information, along with the receipt date, receipt number, and payment method.

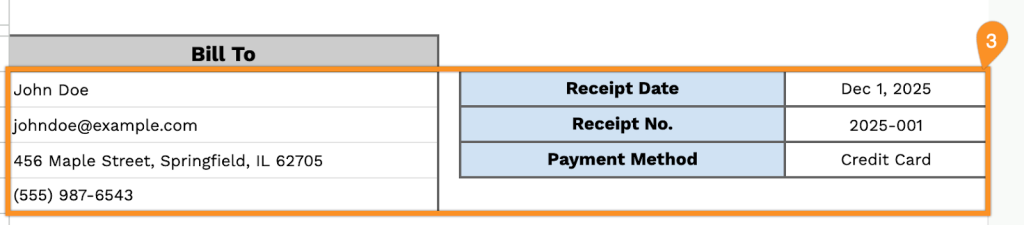

4. List the items or services donated, including quantity and value for each. The template will automatically calculate the line totals.

5. The template will automatically calculate the total donation value.

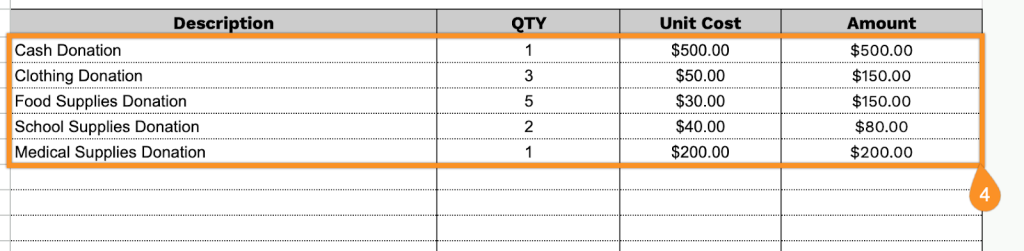

6. Use the Notes section to include any essential details or messages for the donor.