A balance sheet gives you a clear snapshot of where your business stands financially: what you own, what you owe, and what’s left over. But creating one from scratch? That’s the time you don’t have.

That’s why we’ve created six free balance sheet templates for 2025 that’ll save you hours of work. Whether you prefer Google Sheets, Excel, or PDF, these templates are ready to download and use right away.

Let’s find the one that works for you.

Quick Jump

ToggleWhat Is a Balance Sheet Spreadsheet?

A balance sheet is a digital document that organizes a company’s or an individual’s financial information into three main categories: assets (what you own), liabilities (what you owe), and equity (net worth).

This tool helps businesses and individuals track their financial position, make informed decisions, and prepare financial reports.

Why Use Our Balance Sheet Spreadsheet Templates?

Our balance sheet templates eliminate the complexity and cost of creating professional financial statements from scratch, even without an accounting background.

Each template includes automatic calculations, built-in balance verification, and organized structures that ensure accuracy while saving you time.

Available in Google Sheets, Excel, and PDF formats, these free downloadable templates are fully customizable to match your specific business needs.

How to Use Our Balance Sheet Spreadsheet Templates

- Begin by downloading a balance sheet template of your choice as an Excel or PDF file, or creating a personal copy in Google Sheets.

- Customize the template based on your business’s specific requirements..

- Fill in your asset values in the Assets section, then move to the Liabilities and Equity section and enter amounts for each line item. All subtotals and grand totals will calculate automatically.

- Verify that your balance sheet is accurate by confirming that total assets equal total liabilities plus equity.

- Review all sections and ensure all data points are accurate and up-to-date before submitting the template for approval from relevant stakeholders or using it for financial reporting.

6 Free Balance Sheet Spreadsheet Templates

Each of these balance sheet templates is entirely free and available in multiple formats: download as Excel, save as a PDF, or make a copy directly in Google Sheets.

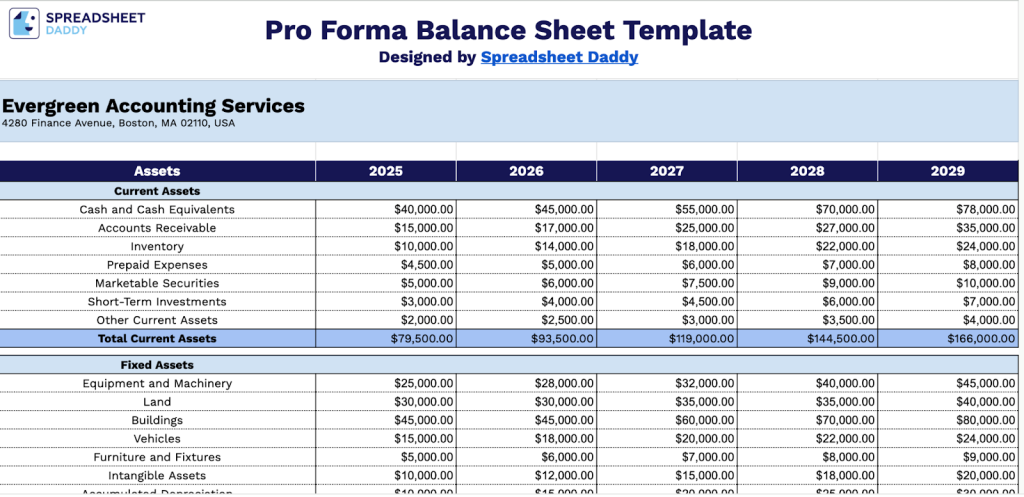

1. Pro Forma Balance Sheet Template

This template is designed to create pro forma balance sheets that project your company’s future financial position.

It enables forward-looking financial planning by allowing you to forecast assets, liabilities, and equity across multiple years.

What’s included

- Five-year projection layout: Track your finances from 2025-2029 with yearly columns for easy trend comparison and growth visualization of assets, liabilities, and equity.

- Asset tracking: Organized sections for Current Assets (cash, receivables, inventory) and Fixed Assets (property, equipment, vehicles) with automatic subtotals rolling into Total Assets.

- Liability categories: Separate short-term (due within a year) and long-term obligations with multiple line items and automatic subtotals for complete debt tracking.

- Equity section: Adaptable for any business structure with line items for stock types, retained earnings, paid-in capital, and owner’s equity.

- Built-in balance check: Automatically verifies accuracy by calculating the difference between Total Assets and Total Liabilities & Equity.

Ideal for

Businesses prepare financial projections for investors, lenders, and strategic planning.

2. Daily Balance Sheet Template

Our Daily Balance Sheet Template captures your company’s financial position on a specific date with a simple, single-column format.

It offers a snapshot view of assets, liabilities, and equity for precise day-to-day financial monitoring.

What’s included

- Asset tracking: Organized into Current and Fixed Assets with automatic subtotals and overall totals for complete visibility of company resources.

- Liability classification: Separates Current from Long-Term Liabilities with subtotals to help manage short-term obligations and long-term commitments for better cash flow planning.

- Equity section: Tracks Paid-In Capital, Retained Earnings, Owner Withdrawals, and Accumulated Other Comprehensive Income with automatic totals, showing ownership value and business performance.

- Balance verification: Built-in formulas automatically check that Total Assets equal Total Liabilities & Equity, displaying $0.00 when balanced.

- Professional header: Customizable fields for Company Name, Address, and Prepared/Reviewed By signatures with dates for proper documentation and stakeholder reporting.

Ideal for

Businesses that require frequent financial updates or need to track their financial position at specific points in time.

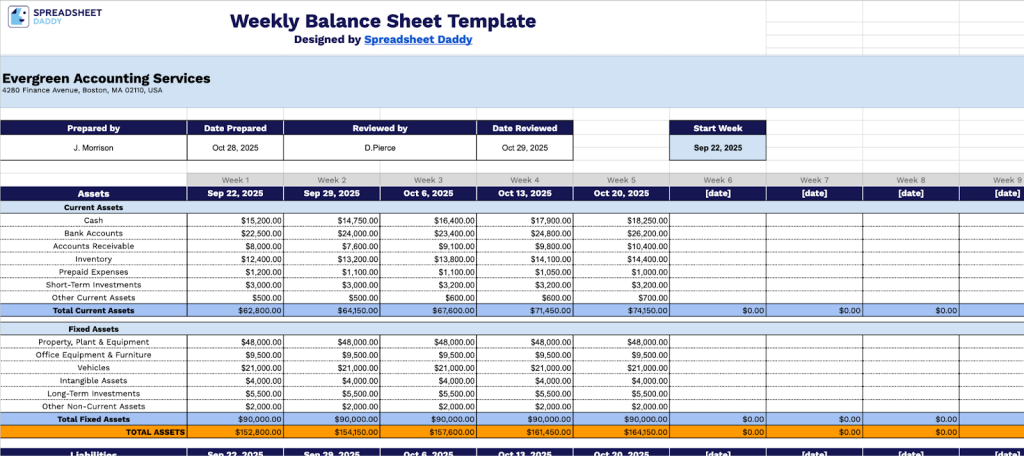

3. Weekly Balance Sheet Template

This Weekly Balance Sheet Template tracks your company’s financial position across multiple weeks with a year-to-date summary column.

It bridges the gap between daily and monthly reporting by providing week-by-week visibility into your assets, liabilities, and equity.

What’s included

- 12-week tracker with YTD summary: Track finances across 12 consecutive weeks plus a Year-to-Date column to spot trends and monitor weekly balance sheet changes.

- Asset categories with auto-calculations: Assets are divided into Current and Fixed, with automatic subtotals rolling up to Total Assets.

- Two-tier liability breakdown: Liabilities are split into Current and Long-Term categories, each with automatic subtotals for precise short- and long-term obligation tracking.

- Shareholders’ equity section: Monitors five key equity components (Common Stock, Additional Paid-In Capital, Retained Earnings, Treasury Stock, and Accumulated Other Comprehensive Income) with automatic totals.

- Balance verification system: Automatically verifies that the accounting equation stays balanced across all weeks.

Ideal for

Businesses that need more frequent financial monitoring than monthly statements but less granular detail than daily tracking.

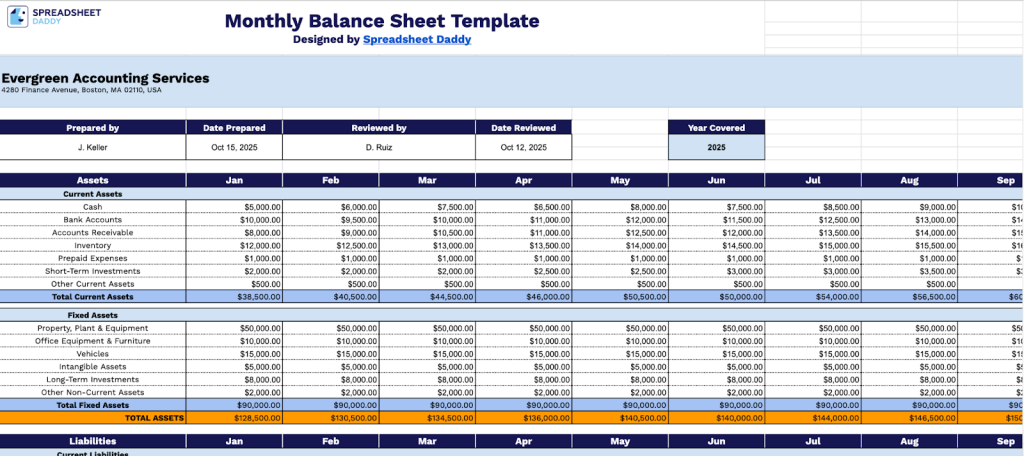

4. Monthly Balance Sheet Template

This Monthly Balance Sheet Template tracks your company’s financial position across all twelve months of the year with a year-to-date summary column.

It provides month-by-month visibility into how your assets, liabilities, and equity change throughout the year.

What’s included

- Year-round monthly tracking: Monitor all 12 months plus a Year-to-Date summary to spot trends and track changes in your financial position throughout the year.

- Standard three-part accounting structure: Organized sections for Assets (Current and Fixed), Liabilities (Current and Long-Term), and Shareholders’ Equity for precise financial tracking.

- Auto-calculating currency fields: All amounts display in currency format with automatic subtotals and master totals for each category, eliminating manual calculations.

- Customizable documentation header: Add your Company Name, Address, preparer and reviewer details, dates, and covered year for proper attribution and audit trails.

- Automatic balance checker: A built-in verification row confirms Assets equal Liabilities plus Equity across all months, catching errors instantly and ensuring accuracy.

Ideal for

Businesses that need to monitor their financial health monthly and identify trends over time.

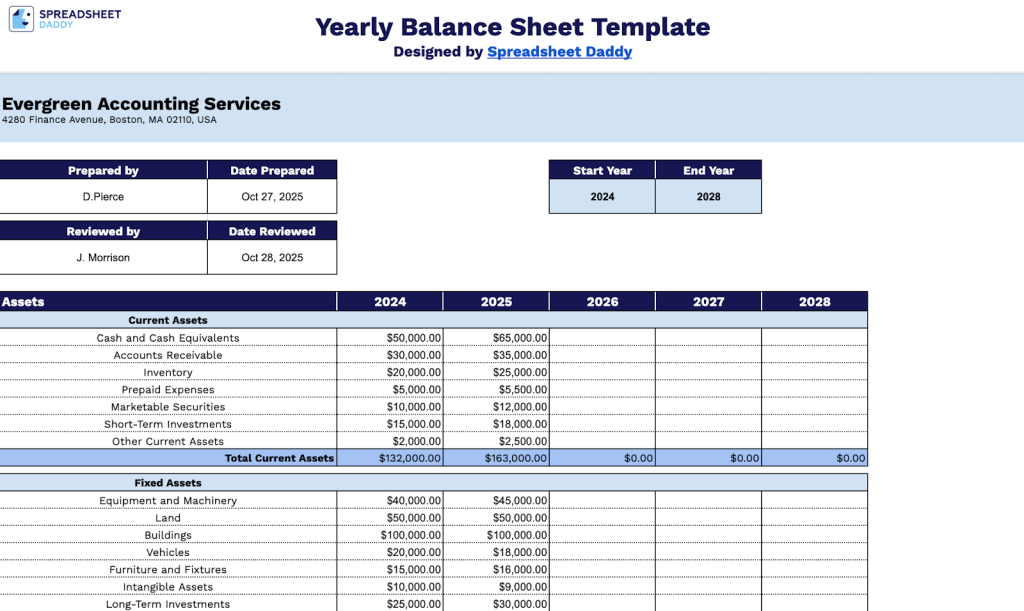

5. Yearly Balance Sheet Template

This Yearly Balance Sheet Template displays your company’s financial position across five consecutive years for long-term trend analysis.

It enables you to track how assets, liabilities, and equity evolve year over year in a single view.

What’s include

- Five-year financial tracking: Monitor your company’s complete financial position with automatic calculations and professional currency formatting for each year.

- Asset organization: Assets divided into Current and Fixed categories for clear visibility into liquidity and long-term value.

- Liability monitoring: Separate tracking of Current and Long-Term Liabilities to support effective cash flow planning.

- Equity documentation: Complete tracking of all equity components (Common Stock, Preferred Stock, Paid-In Capital, Retained Earnings, Treasury Stock, and Other Comprehensive Income) showing ownership structure and profit retention.

- Automatic validation: Built-in balance verification ensures Total Assets equal Total Liabilities & Equity each year, maintaining accounting accuracy.

Ideal for

Businesses conducting multi-year financial reviews, comparing annual performance, or presenting historical financial data to stakeholders.

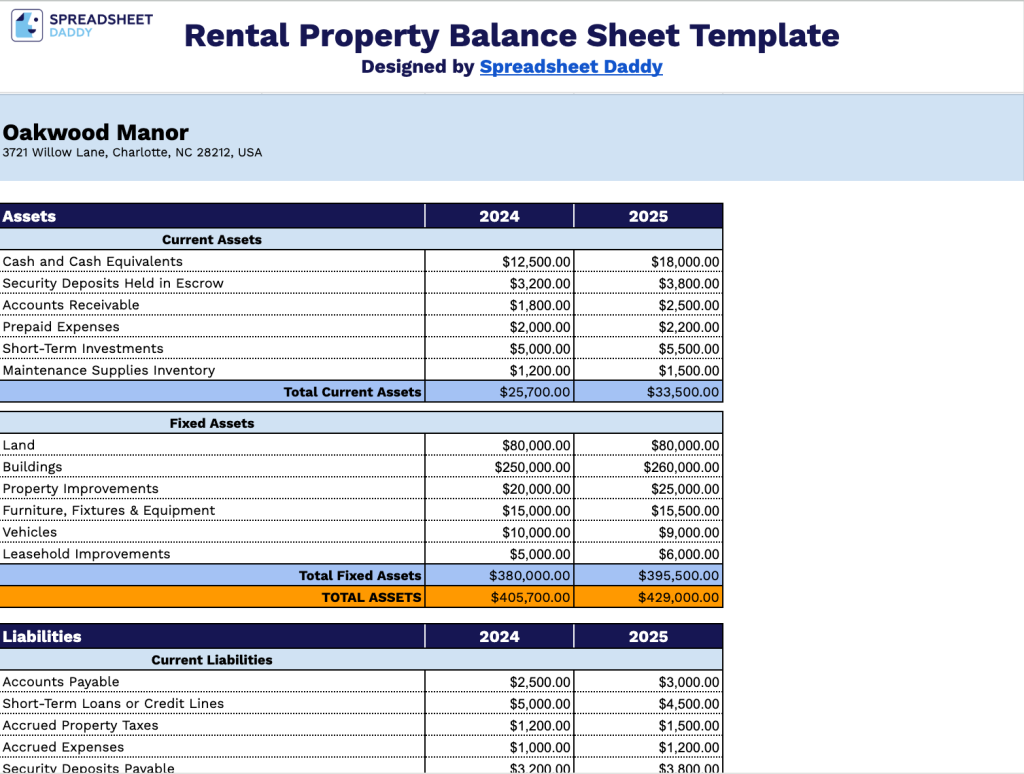

6. Rental Property Balance Sheet Template

Our Rental Property Balance Sheet Template is tailored specifically for real estate investments with property-specific asset and liability categories.

It includes specialized line items like security deposits, maintenance supplies, property improvements, and mortgage payables relevant to rental operations.

What’s include

- Two-year asset comparison: Track assets across 2024 and 2025 with side-by-side columns showing year-over-year changes. Assets are divided into Current and Fixed categories with automatic subtotals.

- Organized liability structure: Liabilities are split between Current and Long-Term categories, helping you easily differentiate short-term dues from long-term debts.

- Flexible equity section: Accommodates various ownership types, including common stock, partner capital, retained earnings, paid-in capital, and revaluation surplus.

- Automatic balance verification: Built-in formulas calculate totals for assets, liabilities, and equity, with instant balance checks to catch errors without manual review.

- Property-specific customization: Header fields for property name and address allow easy management of multiple rental properties with clear labeling for tax and financial purposes.

Ideal for

Landlords and property investors who need to track the financial position of individual rental properties or their entire portfolio.