Managing payroll doesn’t have to be complicated or expensive. Whether you’re a small business owner, freelancer, or independent contractor, having a professional pay stub template can save you time and ensure you’re keeping accurate records for tax purposes.

In this guide, we’re sharing a free, downloadable pay stub spreadsheet template that works seamlessly in Google Sheets, Excel, and PDF format.

This ready-to-use template makes it simple to create professional pay stubs in minutes, with no accounting degree or expensive software required.

Quick Jump

ToggleWhat Is a Pay Stub Spreadsheet?

A pay stub spreadsheet is a digital document that records and calculates employee wage information, including gross pay, deductions, taxes, and net pay for each pay period.

These spreadsheets help maintain accurate payroll records and provide employees with documentation of their earnings and withholdings.

Download Spreadsheet Daddy’s Free Pay Stub Spreadsheet

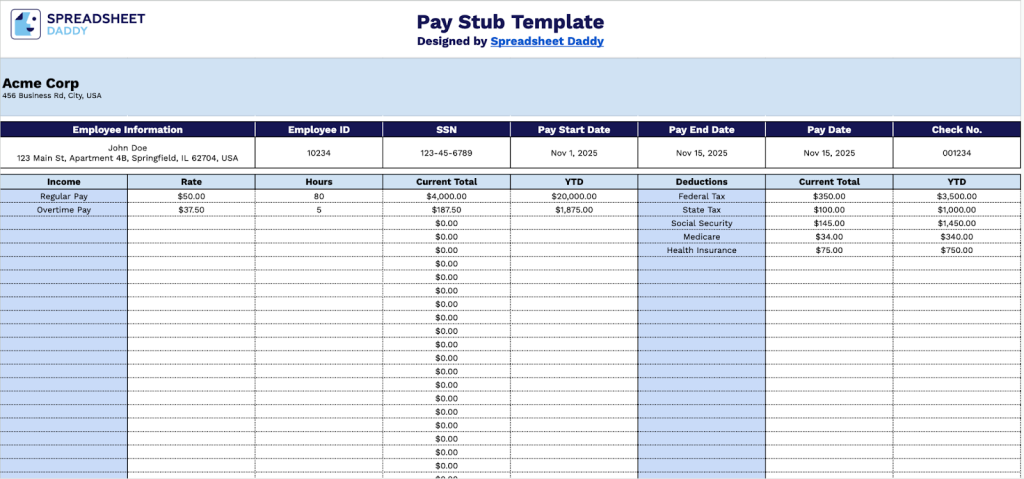

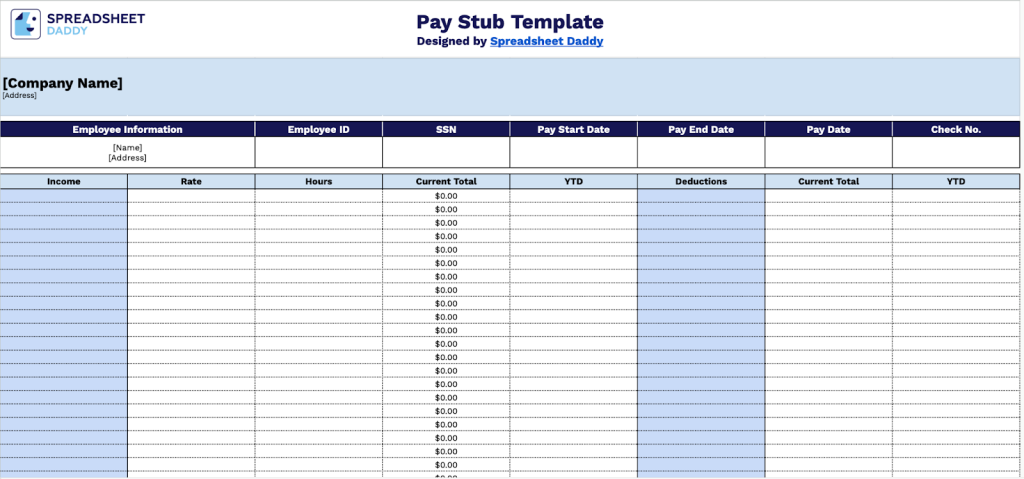

Our professional Pay Stub Template provides a clear and organized format for documenting employee compensation and payroll information.

You can fully customize this template by adding or removing columns to fit your specific payroll needs, whether you need additional income categories, more deduction types, or other custom fields.

What’s included

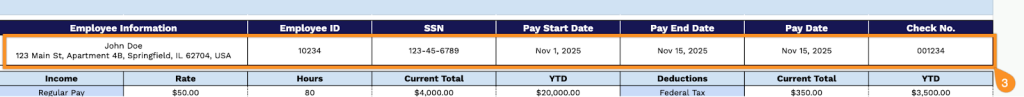

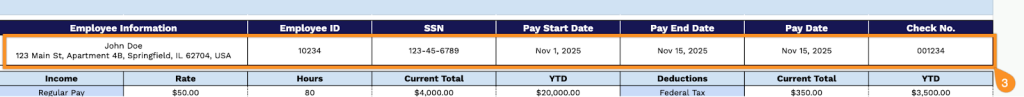

- Customizable company and employee branding section: The professional header area features editable fields for your company name and address, as well as comprehensive employee information, including name, address, employee ID, SSN, pay period dates (start, end, and payment date), and check number, for complete payroll documentation.

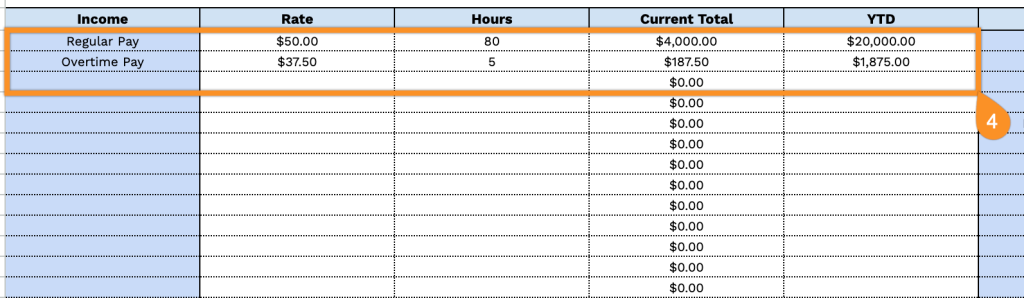

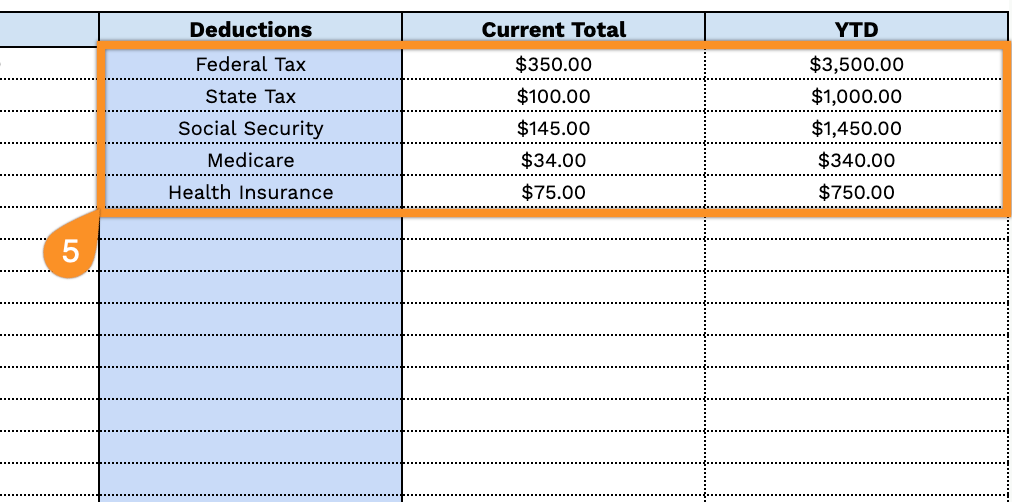

- Dual-column income and deductions tracking system: The left column captures all income sources with fields for rate, hours worked, current period amounts, and year-to-date totals, while the right column mirrors this structure for deductions, giving you a clear side-by-side view of earnings versus withholdings.

- Generous line-item capacity with pre-formatted currency fields: Multiple rows let you track various income types (regular wages, overtime, bonuses, commissions) and deduction categories (federal tax, state tax, Social Security, Medicare, health insurance, 401(k), garnishments).

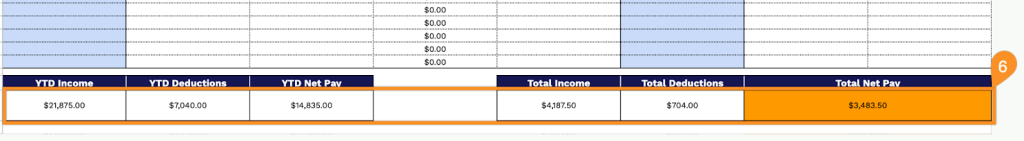

- Comprehensive financial summary section: The bottom displays six key totals in two rows. The first shows YTD income, YTD deductions, and YTD net pay, while the second shows total income, total deductions, and total net pay for the current period, making reconciliation quick and easy.

- Clean, professional design with a structured layout: The template employs a simple format featuring clear section headers, organized data fields, and consistent currency formatting throughout, ensuring that all payroll information is easy to read, calculate, and audit.

How to Use Our Pay Stub Spreadsheet Template

1. To create your pay stub, download the template as an Excel or PDF file, or make a copy of the Google Sheets version.

2. Enter your company name and address at the top of the template.

3. Input the employee’s name, employee ID, Social Security Number (SSN), pay period start and end dates, pay date, and check number.

4. Record earnings and compensation:

- Income: Enter the type of earnings (e.g., regular wages, overtime, bonus, commission).

- Rate: Record the hourly wage or salary rate for each income type.

- Hours: Specify the number of hours worked during the current pay period.

- Current Total: The spreadsheet automatically calculates the gross earnings for the current pay period.

- YTD: Enter the cumulative year-to-date total for all earnings from January 1 through the current pay period.

5. Enter deductions and withholdings:

- Deductions: List each withholding category (e.g., federal tax, state tax, Social Security, Medicare, health insurance).

- Current Total: Record the deduction amount withheld from the current pay period.

- YTD: Enter the cumulative year-to-date total for each deduction type from January 1 through the current pay period.

6. The template automatically calculates YTD Income, YTD Deductions, YTD Net Pay, as well as the current period’s Total Income, Total Deductions, and Net Pay.