Managing rental properties effectively requires organization and accurate record keeping. Without a clear system in place, important financial details can slip through the cracks, making it difficult to assess property performance or prepare for tax season.

A well-structured spreadsheet provides a straightforward solution for landlords at any experience level. Our free rental property template offers a practical way to maintain organized records and gain visibility into your investment’s financial health.

The template is available in multiple formats to suit your preferred workflow. Download, customize, and start building a clearer picture of your rental property business today.

Quick Jump

ToggleWhat Is a Rental Property Spreadsheet?

A rental property spreadsheet is a digital tool used by landlords and property managers to track and organize financial information related to their rental properties.

This spreadsheet helps property owners monitor cash flow, calculate profitability, and maintain accurate records for tax purposes and investment analysis.

Download Spreadsheet Daddy’s Free Rental Property Spreadsheet

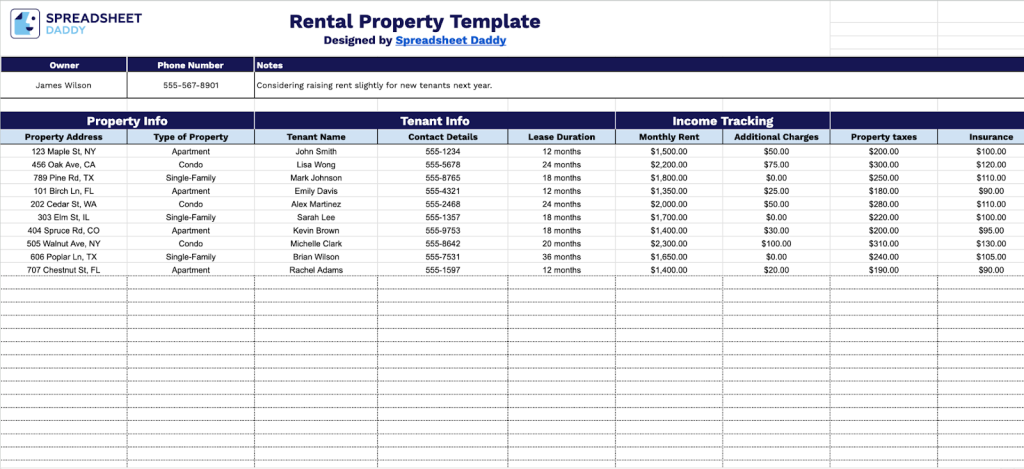

Our Rental Property Template helps you track all essential aspects of your rental business in one organized location.

Tailor it to your needs by seamlessly adding new columns for specialized expenses or removing fields that don’t apply to your properties.

What’s included

- Comprehensive property & tenant management system: Centralized tracking with dedicated columns for property address, property type, tenant name, contact details, and lease duration. This system keeps all critical rental information organized and easily accessible in one place.

- Income tracking module: Monitor revenue streams with designated columns for monthly rent and additional charges, enabling clear visibility of all income sources. The template automatically calculates total monthly income for each property.

- Five-category expense tracking system: Detailed expense management with individual columns for property taxes, insurance, utilities, maintenance, and management fees. This categorization allows for precise cost analysis and identification of spending patterns across your rental portfolio.

- Automated monthly profit calculator: Built-in financial analysis section that automatically computes monthly income, total monthly expenses, and net monthly profit for each property. This real-time calculation provides instant insight into property performance and cash flow.

How to Use Our Rental Property Spreadsheet Template

1. Begin tracking your rental income, expenses, and occupancy by downloading the template as Excel or PDF, or making a Google Sheets copy.

2. Specify the property owner along with their phone number. Capture additional context in the Notes field.

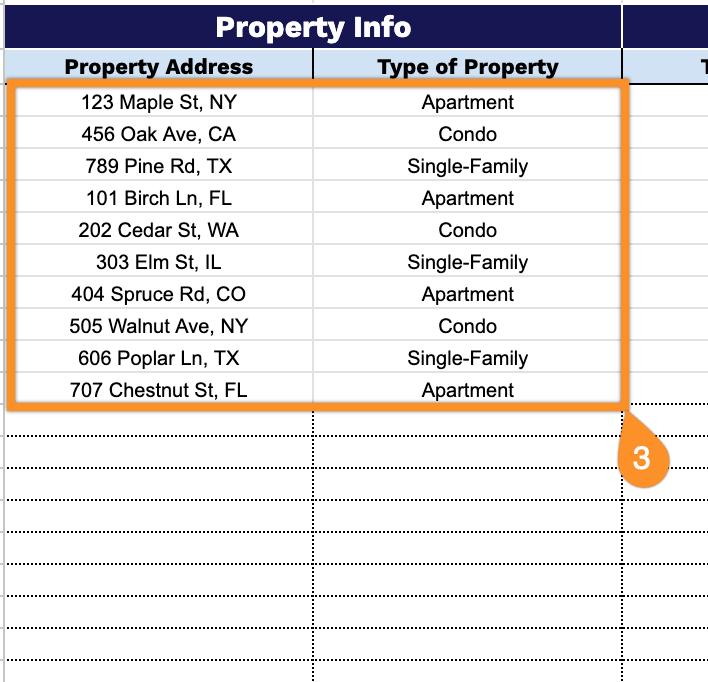

3. Complete the Property Info section by entering all essential property identification and classification details:

- Property Address: Enter the complete address of the rental property.

- Type of Property: Specify the property classification (single-family home, multi-family unit, apartment, condo, townhouse, etc.).

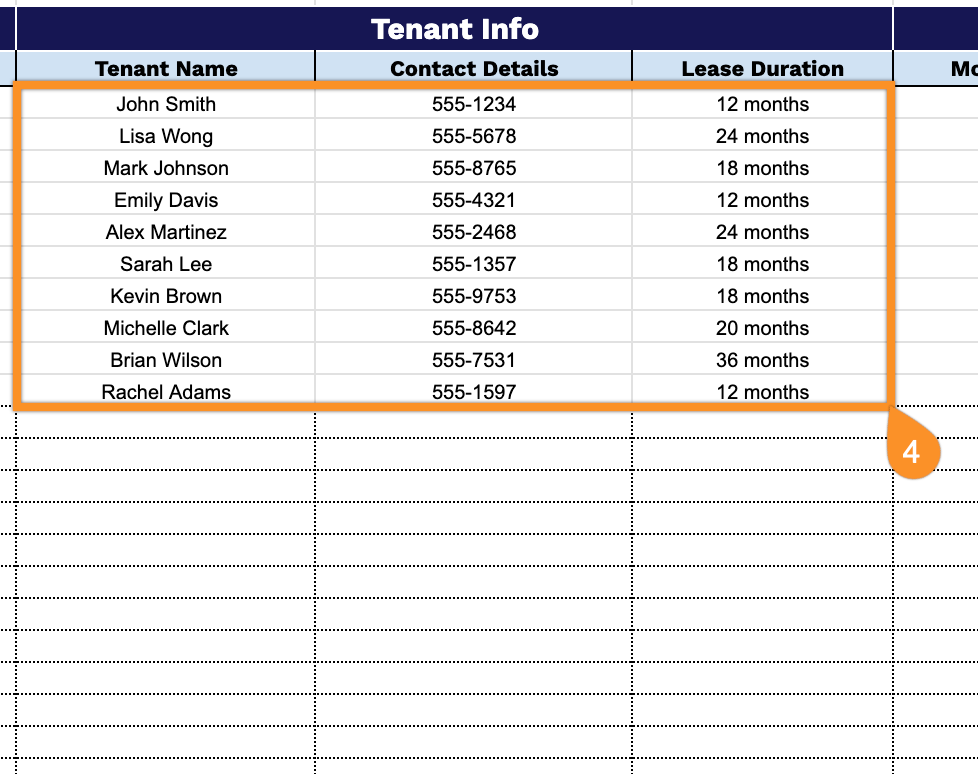

4. Fill in the Tenant Info section by documenting all renter contact and lease details:

- Tenant Name: Enter the full legal name(s) of the tenant(s) occupying the property.

- Contact Details: Provide the tenant’s phone number for communication purposes.

- Lease Duration: Record the total length of the rental agreement.

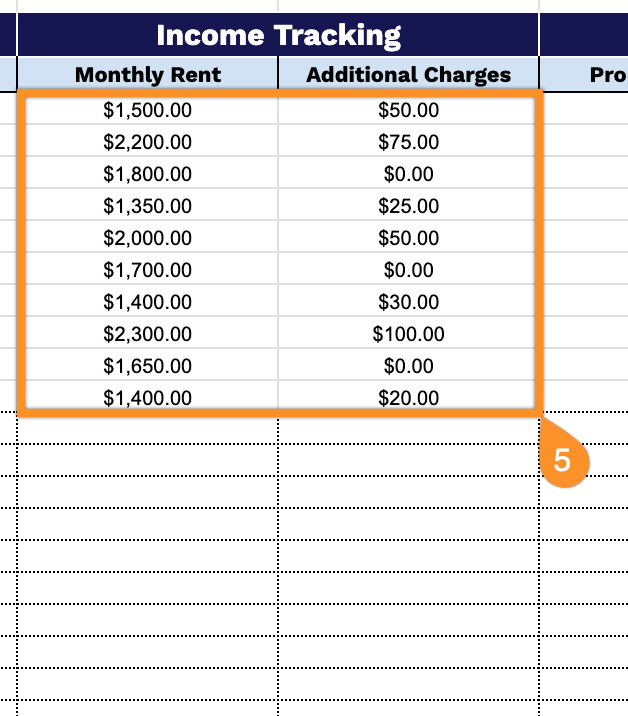

5. Document all revenue sources in the Income Tracking section to monitor property earnings:

- Monthly Rent: Enter the base rent amount the tenant pays each month.

- Additional Charges: Include any supplementary income such as pet fees, parking charges, storage fees, or late payment penalties.

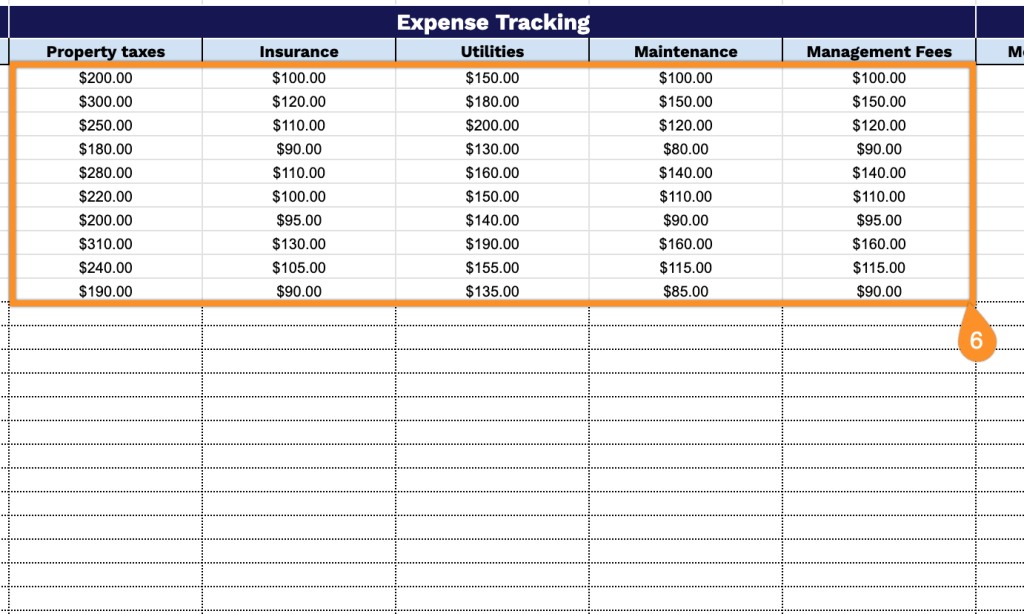

6. Record all property-related costs in the Expense Tracking section to maintain accurate financial records:

- Property Taxes: Enter the monthly portion of annual property tax obligations.

- Insurance: Include the monthly cost of property and liability insurance premiums.

- Utilities: Add any utility expenses paid by the landlord (water, gas, electricity, trash, etc.).

- Maintenance: Record costs for repairs, upkeep, and routine maintenance services.

- Management Fees: Include any property management company fees or service charges.

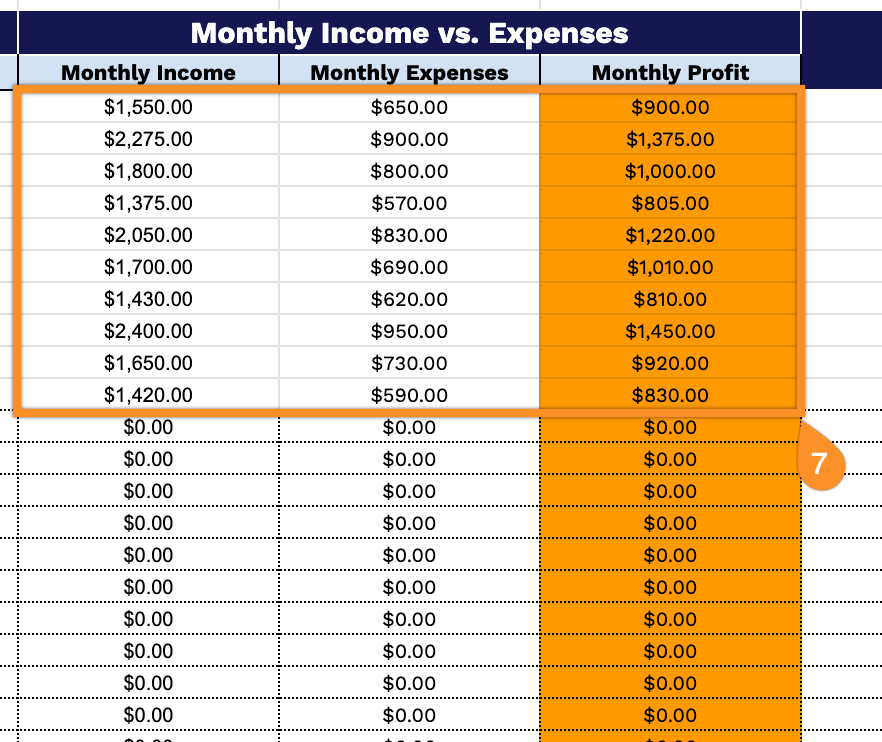

7. Calculate the financial performance in the Monthly Income vs. Expenses section to assess profitability:

- Monthly Income: The spreadsheet automatically sums all revenue sources including rent and additional charges.

- Monthly Expenses: The template adds all costs from property taxes, insurance, utilities, maintenance, and management fees.

- Monthly Profit: You will have the net income automatically calculated in the spreadsheet based on the monthly income and expenses.

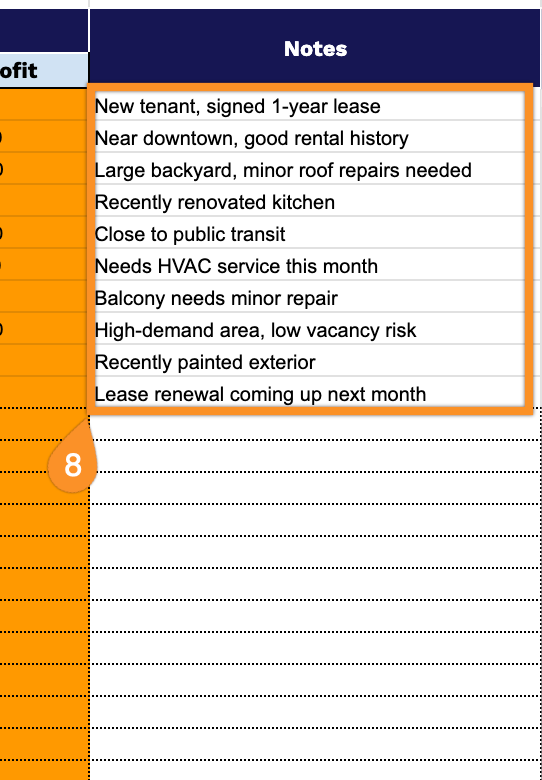

8. Add any remaining relevant details about the property in the Notes field.